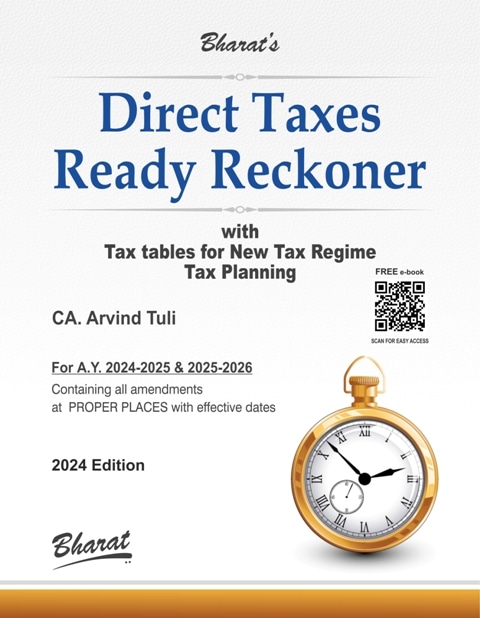

Bharat’s Direct Taxes Ready Reckoner with Tax Planning by CA. Arvind Tuli – 12th Edition 2024

₹2,150.00 Original price was: ₹2,150.00.₹1,505.00Current price is: ₹1,505.00.

Bharat’s Direct Taxes Ready Reckoner with Tax Planning by CA. Arvind Tuli – 12th Edition 2024 for A.Y. 2024-2025 and 2025-2026.

100 in stock

Bharat’s Direct Taxes Ready Reckoner with Tax Planning by CA. Arvind Tuli – 12th Edition 2024 for A.Y. 2024-2025 and 2025-2026.

Bharat’s Direct Taxes Ready Reckoner with Tax Planning by CA. Arvind Tuli – 12th Edition 2024 for A.Y. 2024-2025 and 2025-2026.

About Direct Taxes Ready Reckoner

QRN-1 Amendments at a Glance: Finance Act, 2024 & Finance (No. 2) Bill, 2024

QRN-2 Direct Taxes

QRN-3 Memorandum to Finance (No. 2) Bill, 2024

QRN-4 Rates, Forms and dates of TDS & TCS

QRN-5 Rates of Income Tax for Special incomes

QRN-6 Rates of Direct Tax for Last Ten Years

QRN-7 Tax Obligations with Dates and Forms

QRN-8 Reports and Certificates from an Accountant

QRN-9 Depreciation Table

Chapter 1 Introduction

Chapter 2 Basis of Charge

Chapter 3 Residential Status & Scope of Income

Chapter 4 Deemed Receipt & Deemed Accrual

Chapter 5 Salary

Chapter 6 House Property

Chapter 7 Capital Gains

Chapter 8 Business & Profession

Chapter 9 Other Sources

Chapter 10 Clubbing of Income

Chapter 11 Dividend Income

Chapter 12 Undisclosed Incomes

Chapter 13 Gifts

Chapter 14 Set off or carry forward & set off of losses

Chapter 15 Deductions from GTI

Chapter 16 Insurance & ULIP

Chapter 17 Agricultural Income & Partial Integration

Chapter 18 Assessment of Firms

Chapter 19 Assessment of AOP & BOI

Chapter 20 Assessment of HUF

Chapter 21 Assessment of Political Parties & Electoral Trust

Chapter 22 Assessment of Co-operative Societies

Chapter 23 Tax Regimes

Chapter 24 Assessment of Charitable Trust

Chapter 25 Assessment of Companies

Chapter 26 Returns of Income

Chapter 27 Assessment Procedure

Chapter 28 Appeals and Revision

Chapter 29 TDS & TCS

Part A – Tax Deducted at Source [TDS]

Part B – Tax Collected at Source [TCS]

Chapter 30 Tax Audit & Books of Accounts

Chapter 31 Black Money Act

Chapter 32 Assessment of Business Trusts

Chapter 33 Penalties & Prosecution

Chapter 34 Advance Tax & Interest

Chapter 35 Refund & Recoveries

Chapter 36 Special Provisions for Banks & NBFC

Chapter 37 Investment Fund

Chapter 38 Section 14A

Chapter 39 Interest & Bonus Stripping

Chapter 40 Business Re-organisation

Chapter 41 Non-resident Taxation – Special Provisions

Chapter 42 Board for Advance Rulings

Chapter 43 Encouraging Digital Transactions

Details :

- Publisher : Bharat Law House Pvt. Ltd.

- Author : CA. Arvind Tuli

- Edition : 12th Edition 2024

- ISBN-13 : 9788197729744

- ISBN-10 : 9788197729744

- Pages : 912 pages

- Language : English

- Binding : Paperback

| Publisher | |

|---|---|

| Language | |

| Author |

Be the first to review “Bharat’s Direct Taxes Ready Reckoner with Tax Planning by CA. Arvind Tuli – 12th Edition 2024” Cancel reply

Related products

MSME

Bloomsbury’s Treatise on Micro, Small and Medium Enterprises by Rajeev Babel – 1st Edition June 2021

GST

Bharat’s How to handle GST Audit with real life case studies by CA. Arun Chhajer – 1st Edition 2023

Reviews

There are no reviews yet.