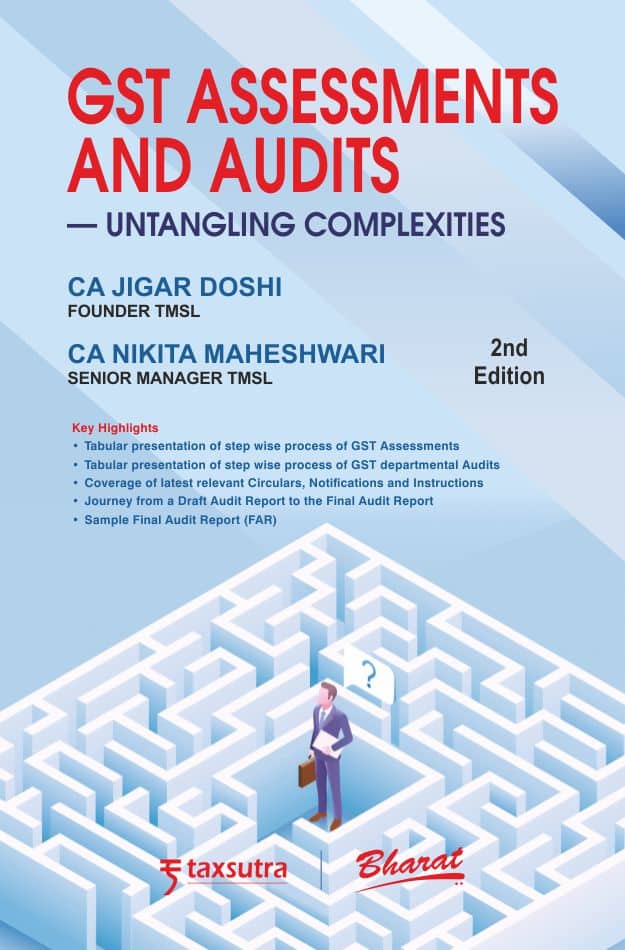

Bharat’s GST Assessments and Audits by Jigar Doshi – 2nd Edition 2023

₹595.00 Original price was: ₹595.00.₹446.00Current price is: ₹446.00.

Bharat’s GST Assessments and Audits – Untangling Complexities by Jigar Doshi – 2nd Edition 2023.

9 in stock

Bharat’s GST Assessments and Audits – Untangling Complexities by Jigar Doshi – 2nd Edition 2023.

Bharat’s GST Assessments and Audits – Untangling Complexities by Jigar Doshi – 2nd Edition 2023.

About GST Assessments and Audits – Untangling Complexities

Chapter 1 Evolving Tax Eco-Systems across the Globe

Chapter 2 Assessment under GST

Chapter 3 GST Assessments – Step wise process

Chapter 4 Audits under GST

Chapter 5 GST Audit – Step wise Process

Chapter 6 Approach of Stakeholders

Chapter 7 Judiciary’s take on GST Assessments and Audits

Chapter 8 How to Handle your GST Assessments and Audits

Chapter 9 Is your Assessments and Audits only yours?

Chapter 10 Repercussions of not Handling GST Assessments and Audits Right

Chapter 11 How Technology Can Help

Chapter 12 FAQs to understand Assessments and Audits in a better way

Appendix 1 Assessment Forms

Appendix 2 Circular No. 129/48/2019-GST, dated 24-12-2019

Appendix 3 Instructions/Circulars

Appendix 4 Notification

Appendix 5 Circular No. 31/05/2018-GST, dated 9-2-2018

Appendix 6 Circular No. 1053/02/2017-CX, dated 10-3-2017

Appendix 7 Instruction No. 02/2022-GST, dated 22-3-2022

Appendix 8 Sample Final Audit Report Issued under section 65

About Authors:

Jigar Doshi : The author CA Jigar Doshi, is a seasoned professional with over 15 years of experience in the field of Indirect Taxation. The tenured experience has allowed witnessing a transition from VAT to Service Tax and then to GST regime. Collecting from these learnings, the book operates from a practical level of how the industry accustoms and how it

should accustom itself to such changes. Having conducted and being on the panel of a Government training platform, it further helps in stepping into the Government’s shoes.

Also practicing under other international VAT practices, is a trainer at various forums undertaking seminars for GCC VAT. Further, a holder of

the ‘Young Accountant of the Year’ hosted by the International Accounting Bulletin (IAB) held in United Kingdom in the year 2019 has created a presence in the international market.

Nikita Maheshwari : The co-author CA Nikita Maheshwari is an indirect tax professional with an extensive experience in Service tax and GST. She has led and executed GST transition for various MNCs in India. She is also an avid reader and technical content writer. Various interactions with tax authorities coupled with a consulting experience of over 8 years have not only provided her with substantial exposure in understanding the Government’s approach towards assessments and audits but also given her an inside-out view of the industry. This book is her endeavour to bring these perspectives together.

Details :

- Publisher : Bharat Law House Pvt. Ltd.

- Author : Jigar Doshi, Nikita Maheshwari

- Edition : 2nd Edition 2023

- ISBN-13 : 9788196617141

- ISBN-10 : 9788196617141

- Language : English

- Binding : Paperback

| Publisher | |

|---|---|

| Language | |

| Author |

Reviews

There are no reviews yet.