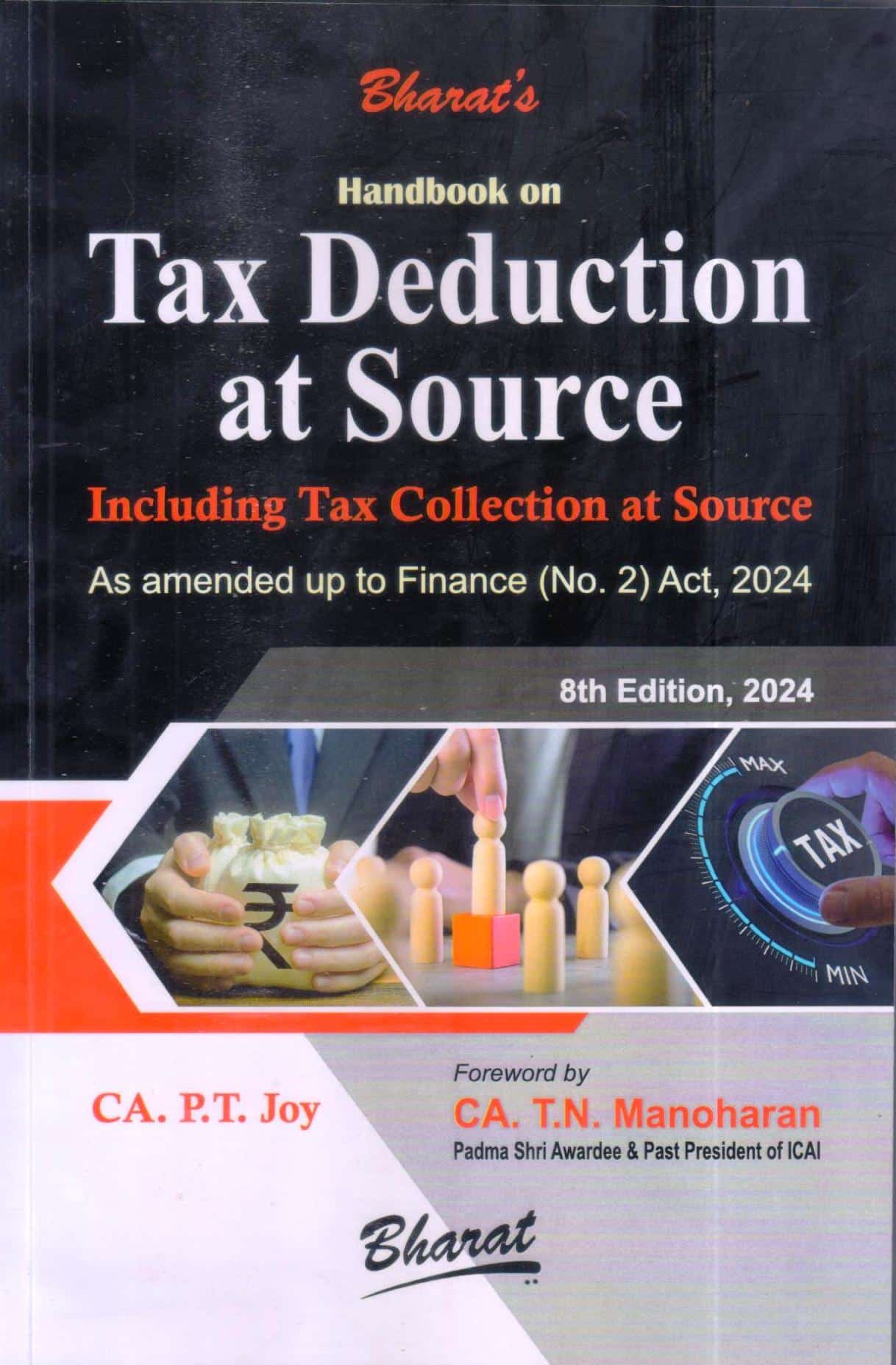

Bharat’s Handbook on Tax Deduction At Source by CA. P.T. Joy

₹750.00 Original price was: ₹750.00.₹563.00Current price is: ₹563.00.

Bharat’s Handbook on Tax Deduction At Source Including Tax Collection At Source As amended by the Finance Act, 2024 by CA. P.T. Joy – 8th Edition 2024.

10 in stock

Bharat’s Handbook on Tax Deduction At Source Including Tax Collection At Source As amended by the Finance Act, 2024 by CA. P.T. Joy – 8th Edition 2024.

Bharat’s Handbook on Tax Deduction At Source Including Tax Collection At Source As amended by the Finance Act, 2024 by CA. P.T. Joy – 8th Edition 2024.

About Handbook on Tax Deduction At Source

Chapter 1 Collection and Recovery of Tax — Introduction

Chapter 2 Section 192 — TDS on Salary

Chapter 3 Section 192A — Payment of accumulated balance to employees

Chapter 4 Section 193 — TDS from Interest on Securities

Chapter 5 Section 194 — TDS from Dividends

Chapter 6 Section 194A — TDS from Interest other than Interest on Securities

Chapter 7 Section 194B — TDS from Winnings from Lottery or Crossword Puzzle, etc.

Chapter 8 Section 194BA— Winnings from Online Games

Chapter 9 Section 194BB — TDS from Winnings from Horse Races

Chapter 10 Section 194C — TDS from Payments to Contractors

Chapter 11 Section 194D —TDS on Insurance Commission

Chapter 12 Section 194DA — TDS from Payment in Respect of Life Insurance Policy

Chapter 13 Section 194E — TDS from Payments to Non-resident Sportsmen or Sports Associations

Chapter 14 Section 194EE — TDS from Payments in respect of deposits under National Savings Scheme, etc.

Chapter 15 Section 194F — TDS from Payment on account of repurchase of units by Mutual Fund or Unit Trust of India — (omitted w.e.f. 01.10.2024)

Chapter 16 Section 194G — TDS on Commission etc., on sale of lottery tickets

Chapter 17 Section 194H — TDS on Commission and Brokerage

Chapter 18 Section 194-I — TDS from Rent

Chapter 19 Section 194-IA — TDS on Payment on Transfer of certain Immovable Property (other than agricultural land)

Chapter 20 Section 194-IB — TDS on Payment of rent by Certain Individuals or Hindu Undivided Family

Chapter 21 Section 194-IC — TDS on Payment under Specified Agreement

Chapter 22 Section 194J — TDS from Fees for Professional or Technical Services or Royalty or Non-Compete Fee

Chapter 23 Section 194K — TDS on Income in respect of Units

Chapter 24 Section 194LA — TDS on Payment of Compensation on Acquisition of certain Immovable Property (Other Than Agricultural Land)

Chapter 25 Section 194LB — TDS from income by way of interest from Infrastructure Debt Fund

Chapter 26 Section 194LBA — TDS on Income from Units of Business Trusts

Chapter 27 Section 194LBB — TDS from Income in respect of Units of Investment Fund

Chapter 28 Section 194LBC — TDS from Income in Respect of Investment in Securitization Trust

Chapter 29 Section 194LC — TDS on Income by way of Interest from Indian Company or the Business Trusts

Chapter 30 Section 194LD — TDS from Income by Way of Interest on Certain Bonds and Government Securities

Chapter 31 Section 194M — Payment of certain sums by certain Individuals or Hindu Undivided Family

Chapter 32 Section 194N — Payment of Certain Amounts in Cash (Substituted w.e.f. 01-07-2020)

Chapter 33 Section 194-O — Payment of Certain Sums by E-Commerce Operator to E-Commerce Participant (applicable w.e.f. 01-10-2020)

Chapter 34 Section 194P – TDS in the case of Specified Senior Citizen (applicable w.e.f. 01.07.2021)

Chapter 35 Section 194Q — TDS on payment of certain sum for purchase of goods (applicable w.e.f. 01.07.2021)

Chapter 36 Section 194R – TDS on Benefit of Perquisite in respect of Business or Profession (w.e.f. 01.07.2022)

Chapter 37 Section 194S – TDS on Transfer of Virtual Digital Asset

Chapter 38 Section 194T — Payment to partners of Firm (w.e.f. 01.04.2025)

Chapter 39 Section 195 — Other Sums

Chapter 40 Section 195A —Income payable Net of Tax

Chapter 41 Section 196 — TDS from Interest or Dividend or Other Sums Payable to Government, Reserve Bank or Certain Corporations

Chapter 42 Section 196A — TDS from Income in respect of Units of Non-Residents

Chapter 43 Section 196B —TDS on Income from Units

Chapter 44 Section 196C — TDS from Income from foreign currency bonds or shares of Indian Company

Chapter 45 Section 196D — TDS from Income of Foreign Institutional Investors from Securities

Chapter 46 Miscellaneous Provisions of TDS

Chapter 47 Section 206AB — Special Provisions for Deduction of Tax at Source for Non-filers of Income Tax Return

Chapter 48 Section 206C — Tax Collection at Source

Chapter 49 Section 206CCA — Special Provisions for Collection of Tax at Source for Non-filers of Income Tax Return

Chapter 50 Certificate, Statement and Return of Tax Deducted/Collected at Source

Chapter 51 Consequences of Failure to Deduct or Pay

Details :

- Publisher : Bharat Law House Pvt. Ltd.

- Author : CA. P.T. Joy

- Edition : 8th Edition 2024

- ISBN-13 : 9788119565788

- ISBN-10 : 9788119565788

- Pages : 352 pages

- Language : English

- Binding : Paperback

| Publisher | |

|---|---|

| Language | |

| Author |

Be the first to review “Bharat’s Handbook on Tax Deduction At Source by CA. P.T. Joy” Cancel reply

Related products

International Taxation

Income Tax

Commercial’s Filing of Indian Income Tax Updated Return by Ram Dutt Sharma – Edition 2023

Reviews

There are no reviews yet.