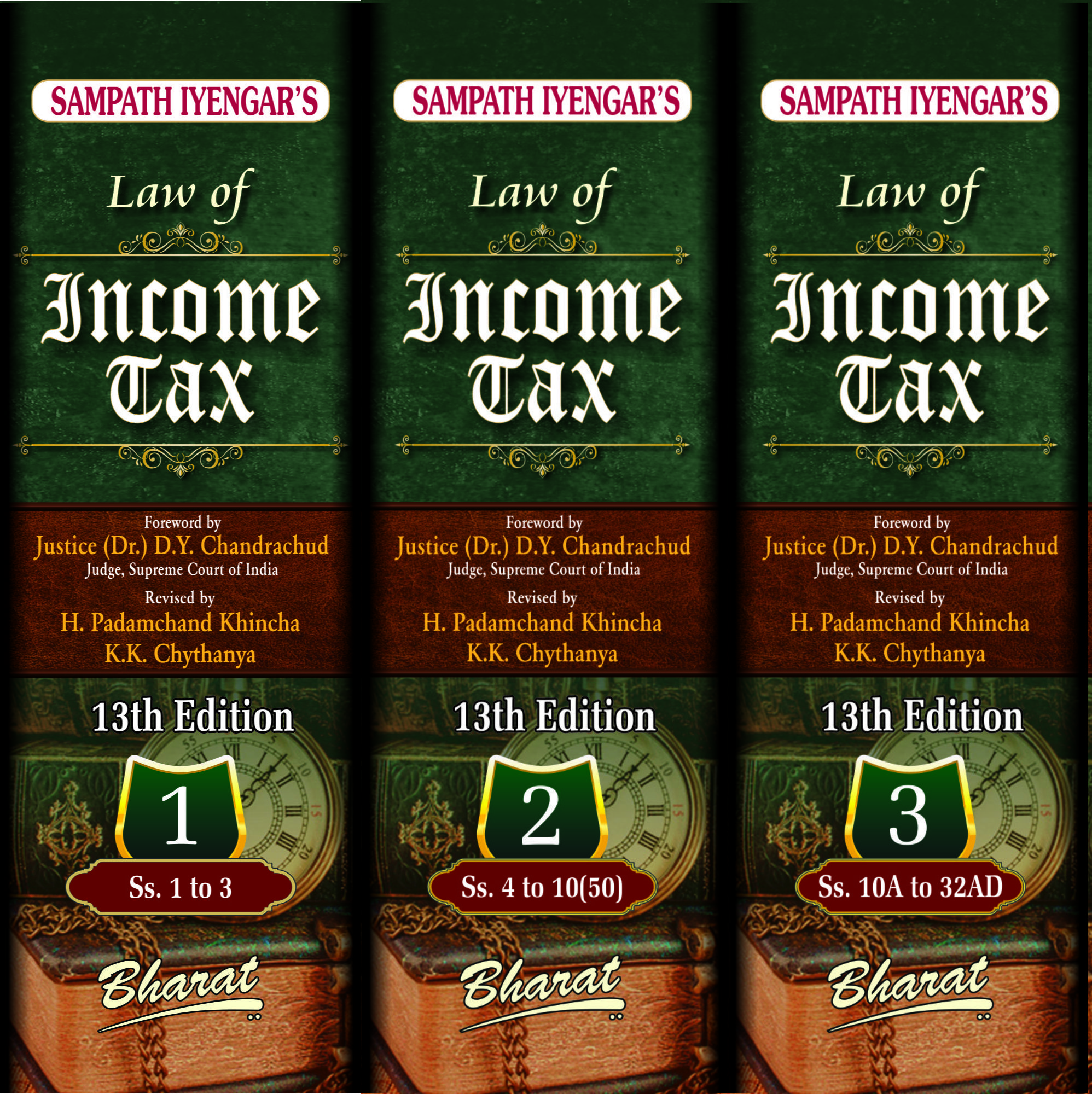

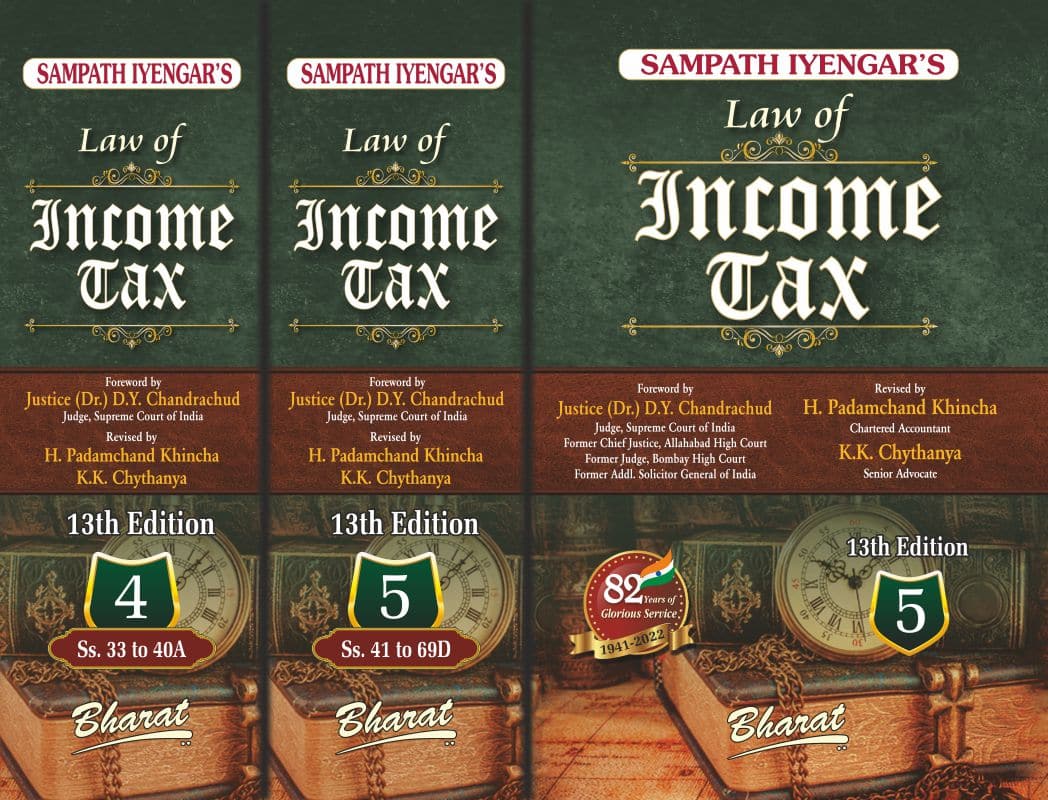

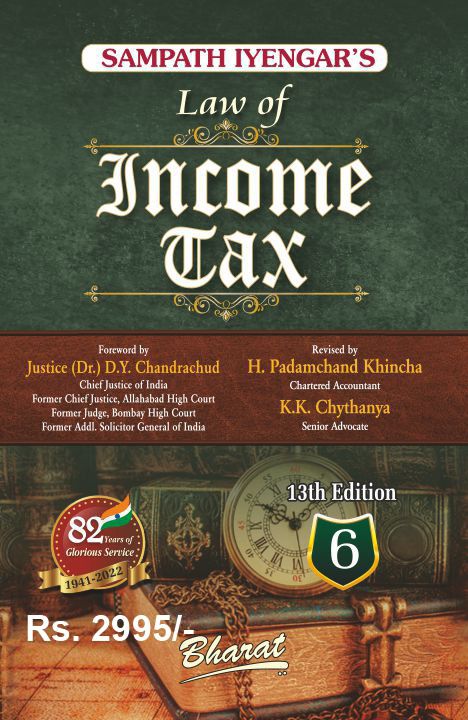

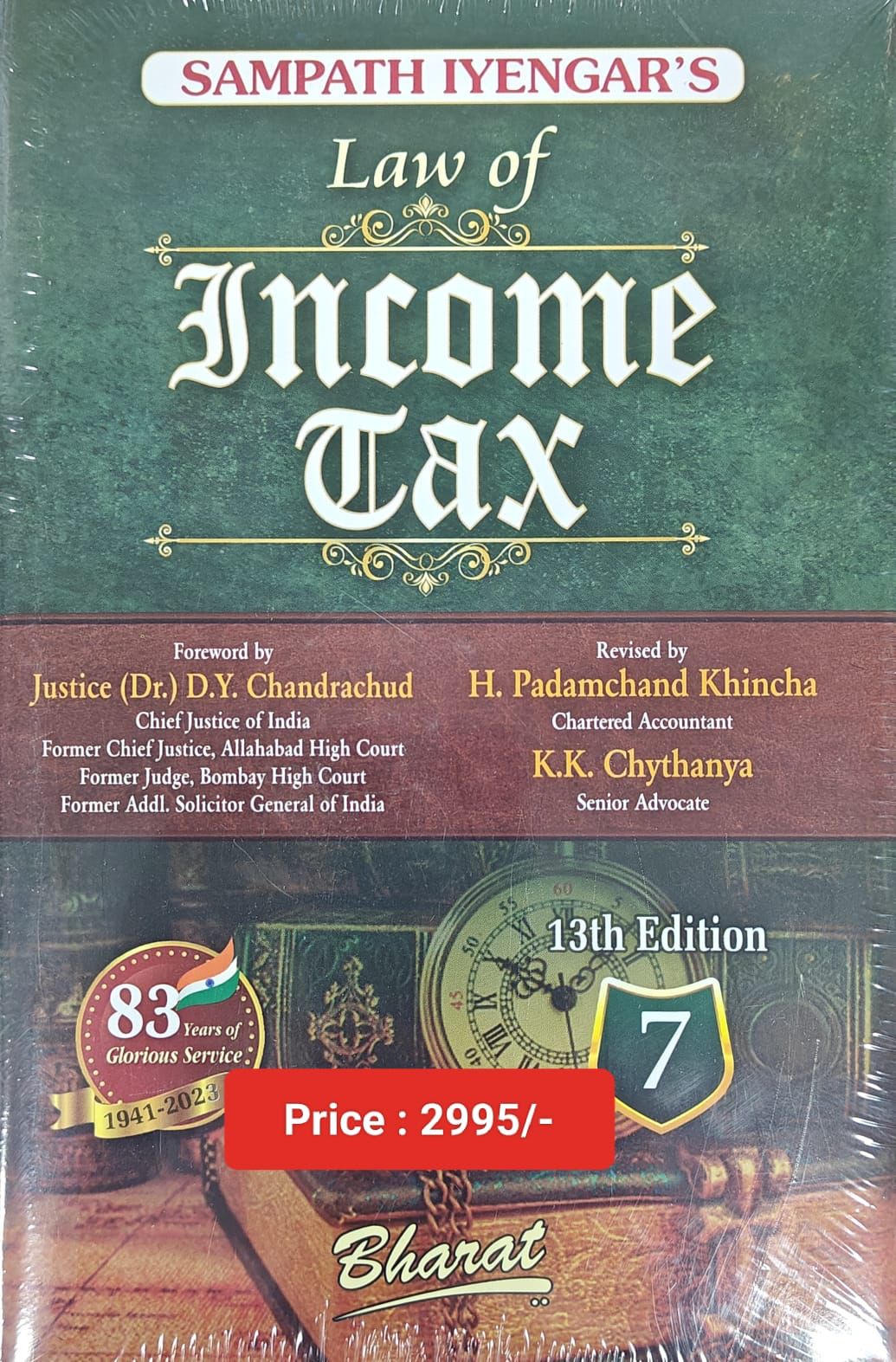

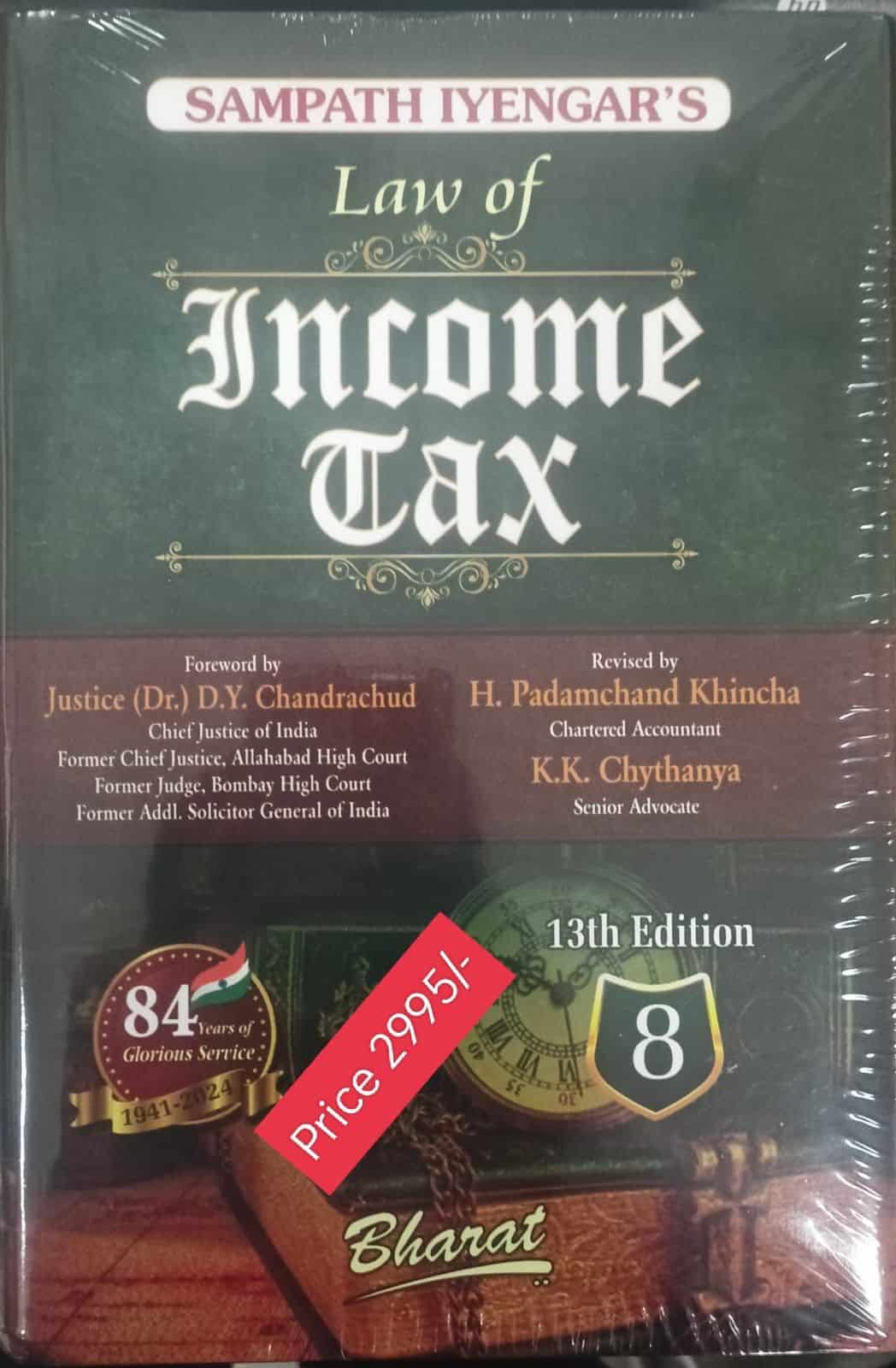

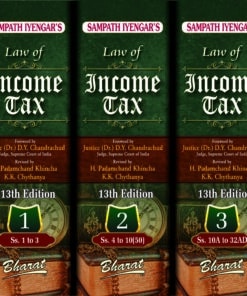

Bharat’s Law of Income Tax (Volume 1 to 9) By Sampath Iyengar – 13th Edition 2024

₹26,955.00 Original price was: ₹26,955.00.₹21,564.00Current price is: ₹21,564.00.

Bharat’s Law of Income Tax (Volume 1 to 9) By Sampath Iyengar – 13th Edition 2024.

8 in stock

Bharat’s Law of Income Tax (Volume 1 to 9) By Sampath Iyengar – 13th Edition 2024.

Bharat’s Law of Income Tax (Volume 1 to 9) By Sampath Iyengar – 13th Edition 2024.

About Law of Income Tax (Volume 1 to 9) By Sampath Iyengar

Sampath Iyengar’s Law of Income Tax has maintained its reputation as a commentary, exhaustive and encyclopedic in its sweep, and as a veritable warehouse of all the available information on the subject, besides carrying critical and in-depth comments. It is the most authentic referencer, which has stood the test of time during the last eight decades and has retained its pristine glory. This set provides not only the necessary access to all the relevant information, but also the expertise and the experience of the authors, present and past. Conflicting views are highlighted. Precedents are not merely listed, but their rationale analysed. This book has always been different in not being content with mere listing of cases, but by providing enough material to tackle any problem that may arise. No wonder it is being referred and cited as an authority at all levels of judicial interpretation – Income-tax Department, ITAT, High Courts, Supreme Court and even Authority for Advance Rulings.

While India celebrates its 75 years of Independence, Sampath Iyengar has helped the professionals, tax administrators and the judiciary for the last over 80 years in finding solutions to their tax issues. No effort is spared in the present edition to maintain the reputation, which this book has gained in the field of income-tax law for the past eight decades and more.

This locus classics has enjoyed the privilege of patronage from the profession of chartered accountants, tax practitioners, consultants, advisors, advocates, corporate executives, tax administrators and the judiciary.

Volume 1

INTRODUCTION

PRINCIPLES OF CONSTRUCTION

General Principles

Particular Principles-I

Particular Principles-II

(A) Mutuality Principle

(B) Diversion by Overriding Title

(C) Real Income Theory

(D) Concepts of Telescoping and Peak Credit

Chapter I

Preliminary

1. Short title, extent and commencement

2. Definitions

2(1)“Advance tax”

2(1A)“Agricultural income”

2(1B)“Amalgamation”

2(1C)“Additional Commissioner”

2(1D)“Additional Director”

2(2)“Annual value”

2(3)“Appellate Assistant Commissioner” (Omitted)

2(4)“Appellate Tribunal”

2(5)“Approved gratuity fund”

2(6)“Approved superannuation fund”

2(7)“Assessee”

2(7A)“Assessing Officer”

2(8)“Assessment”

2(9)“Assessment year”

2(9A)“Assistant Commissioner”

2(9B)“Assistant Director”

2(10)“Average rate of income-tax”

2(11)“Block of assets”

2(12)“Board”

2(12A)”Books or books of account”

2(13)“Business”

2(13A)“Business trust”

2(14)“Capital asset”

2(15)“Charitable purpose”

2(15A)“Chief Commissioner”

2(15B)“Child”

2(16)“Commissioner”

2(16A)“Commissioner (Appeals)”

2(17)“Company”

2(18)“Company in which the public are substantially interested”

2(19)“Co-operative society”

2(19A)“Deputy Commissioner”

2(19AA)”Demerger”

2(19AAA)”Demerged company”

2(19B)“Deputy Commissioner (Appeals)”

2(19C)”Deputy Director”

2(20)“Director”, “manager” and “managing agent”

2(21)“Director General or Director”

2(22)“Dividend”

2(22A)“Domestic company”

2(22AA)”Document”

2(22AAA)”Electoral Trust”

2(22B)“Fair market value”

2(23)“Firm”, “partner” and “partnership”

2(23A)“Foreign company”

2(23B)“Fringe benefits”

2(23C)“Hearing”

2(24)“Income”

2(25)“Income-tax Officer”

2(25A)“India”

2(26)“Indian company”

2(26A)“Infrastructure capital company”

2(26B)“Infrastructure capital fund”

2(27)“Inspecting Assistant Commissioner” (Omitted)

2(28)“Inspector of Income-tax”

2(28A)“Interest”

2(28B)“Interest on securities”

2(28BB)”Insurer”

2(28C)”Joint Commissioner”

2(28D)”Joint Director”

2(29)“Legal representative”

2(29A)“Liable to tax”

2(29AA)“Long-term capital asset”

2(29B)“Long-term capital gain”

2(29BA)“Manufacture”

2(29C)“Maximum marginal rate”

2(29D)“National Tax Tribunal”

2(30)“Non-resident”

2(31)“Person”

2(32)“Person who has a substantial interest in the company”

2(33)“Prescribed”

2(34)“Previous year”

2(34A)“Principal Chief Commissioner of Income-tax”

2(34B)“Principal Commissioner of Income-tax”

2(34C)“Principal Director of Income-tax”

2(34D)“Principal Director General of Income-tax”

2(35)“Principal officer”

2(36)“Profession”

2(36A)“Public sector company”

2(37)“Public servant”

2(37A)“Rate or rates in force” or “rates in force”

2(38)“Recognised provident fund”

2(39)“Registered firm” (Omitted)

2(40)“Regular assessment”

2(41)“Relative”

2(41A)”Resulting company”

2(42)“Resident”

2(42A)“Short-term capital asset”

2(42B)“Short-term capital gain”

2(42C)”Slump sale”

2(43)“Tax”

2(43A)“Tax credit certificate”

2(43B)“Tax Recovery Commissioner” (Omitted)

2(44)“Tax Recovery Officer”

2(45)“Total income”

2(46)“Total world income” (Omitted)

2(47)“Transfer”

2(47A)“Virtual digital asset”

2(48)“Zero Coupon Bond”

3. “Previous year” defined

SUBJECT INDEX

Volume 2

Chapter II

Basis of Charge

4. Charge of income-tax

5. Scope of total income

5A. Apportionment of income between spouses governed by Portuguese Civil Code

6. Residence in India

7. Income deemed to be received

8. Dividend income

9. Income deemed to accrue or arise in India

9A. Certain activities not to constitute business connection in India

9B. Income on receipt of capital asset or stock in trade by specified person from specified entity

Chapter III

Incomes which do not form part of total income

10. Incomes not included in total income

10(1)Agricultural income

10(2)Sum received by a member of HUF

10(2A)Share income of partner

10(3)Casual and non-recurring receipts (Omitted)

10(4)Interest income of a non-resident from specified securities, bonds and NRE account

10(4A)Interest income of a non-resident from NRE account in any bank in India (Substituted)

10(4B)Interest income of NRIs on specified savings certificates

10(4C)Interest payable to a non-resident by any Indian company on rupee denominated bond

10(4D)Income accrued or arisen to a specified fund by transfer of capital asset u/s 47(viiab) on a stock exchange in any IFSC

10(4E)Income accrued or arisen by a non-resident from transfer of specified instruments entered into with an offshore banking unit of an IFSC

10(4DF)Income of a non-resident by way of royalty or interest on account of lease of an aircraft or a ship in a previous year, paid by a unit of an IFSC

10(4G)Income received by a non-resident from portfolio of securities, etc in an account maintained with an Offshore Banking Unit in any IFSC

10(5)Value of any travel concession or assistance

10(5A)Remuneration received for rendering services in connection with shooting of cinematograph films by foreign film producers (Omitted)

10(5B)Tax on salaries to technicians (Omitted)

10(6)Specified exemptions to foreign citizens employed in India

10(6A)Tax paid on behalf of a foreign company in respect of royalty or fees for technical services

10(6B)Tax paid by Government or an Indian concern not to form part of the income of non-residents

10(6BB)Tax paid by an Indian company under an approved agreement with foreign Government/enterprise engaged in aircraft business

10(6C)Income by way of fees arising to a specified foreign company for services connected with security of India

10(6D)Income arising to a non-resident by way of royalty from, or fees for technical services rendered to National Technical Research Organisation

10(7)Allowances or perquisites to Indian citizens for services outside India

10(8)Remuneration for duties in India in connection with any co-operative technical assistance programmes and projects

10(8A)Remuneration or fees received by non-resident consultants

10(8B)Remuneration or fees received from non-resident consultants by their foreign employees

10(9)Income of member of family assigned to duties in India under clause (8) or (8A) or (8B)

10(10)Gratuity payment(s)

10(10A)Commutation of pension

10(10AA)Encashment of unutilised earned leave by retiring employees

10(10B)Retrenchment compensation received by a workman

10(10BB)Payments under the Bhopal Gas Leak Disaster Act

10(10BC)Amount received by an individual or his legal hair by way of disaster compensation

10(10C)Compensation received/receivable on voluntary retirement by specified employees

10(10CC)Tax on income in the nature of perquisite paid by employer

10(10D)Sum received under a life insurance policy including bonus

10(11)Payment from a provident fund

10(11A)Payment under an account, Sukanya Samriddhi Account Rules

10(12)Accumulated balance in a recognised provident fund

10(12A)Payment from the National Pension System Trust

10(12B)Payment to an employee from the NPS Trust under pension scheme of section 80CCD

10(13)Payment from an approved superannuation fund

10(13A)Residential accommodation allowance granted by the employer

10(14)Special allowances specifically granted to meet expenses

10(14A)Income received by public financial institution as exchange risk premium (Omitted)

10(15)Interest income on various specified bonds, savings certificates, etc.

10(15A)Payment to acquire an aircraft on lease under an approved agreement

10(16)Educational scholarships

10(17)Specified allowances of MPs, MLAs, etc.

10(17A)Awards and rewards in cash or in kind

10(18)Pension income of award winners

10(18A)Ex gratia payments on abolition of privy purse (Omitted)

10(19)Family pension of a member of armed forces

10(19A)Annual value of a palace in occupation of a Ruler

10(20)Income of a local authority from housing, etc.

10(20A)Income of State Housing Boards, etc (Omitted)

10(21)Income of a scientific research association

10(22)Income of a university or other educational institution (Omitted)

10(22A)Income of a hospital for specified purposes (Omitted)

10(22B)Income of specified news agencies

10(23)Income of specified sports association (Omitted)

10(23A)Income of specified professional association

10(23AA)Income received from regimental or non-public fund

10(23AAA)Income received by any person on behalf of notified fund

10(23AAB)Income of pension fund set up by LIC or any other insurer

10(23B)Income of a public charitable trust for development of khadi or village industries

10(23BB)Income of an authority established for development of khadi or village industries

10(23BBA)Income of statutory bodies or authorities for the administration of public religious or charitable trusts or endowments

10(23BBB)Income of European Economic Community

10(23BBC)Income of SAARC Fund for Regional Projects

10(23BBD)Income of ASOSAI-SECRETARIAT

10(23BBE)Income of Insurance Regulatory and Development Authority

10(23BBF)Income of North-Eastern Development Finance Corporation Limited

10(23BBG)Income of Central Electric Regulatory Commission

10(23BBH)Income of Prasar Bharati

10(23C)Income of specified fund, institution, etc. for charitable purposes, etc.

10(23D)Income of Mutual Funds

10(23DA)Income of a securitization trust

10(23E)Income of specified Exchange Risk Administration Fund (Omitted)

10(23EA)Income of Investor Protection Fund

10(23EB)Income of Credit Guarantee Fund Trust for Small Industries

10(23EC)Income by way of contributions of Investor Protection Fund set up by commodity exchanges

10(23ED)Income by way of contributions received from a depository of Investor Protection Fund

10(23EE)Income of Core Settlement Guarantee Fund

10(23F)Dividend income or long-term capital gains of a venture capital fund/company

10(23FA)Dividend income or long-term capital gains of a venture capital fund/company

10(23FB)Income of venture capital company/fund

10(23FBA)Income of an investment fund

10(23FBB)Income accruing or arising or received by a unit holder

10(23FBC)Income accruing or arising from a specified fund

10(23FC)Income of a business trust

10(23FCA)Income of a business trust, being a real investment trust

10(23FD)Any distributed income received by a unit holder from the business trust

10(23FE)Income of a specified person from specified investments

10(23F)Income by way of dividends or long-term capital gains of a venture capital fund/company

10(23G)Specified income of infrastructure capital fund/company/co-operative bank (Omitted)

10(24)Income of a registered trade union

10(25)Interest on securities and income of certain savings funds

10(25A)Income of ESI Fund

10(26)Income of Scheduled Tribe in specified areas

10(26A)Income of any person in Ladakh

10(26AA)Income of winnings from Sikkim lottery for Sikkim residents (Omitted)

10(26AAA)Income of Sikkemese individuals

10(26AAB)Income of agricultural produce market committee/board

10(26B)Income of any corporation established for promoting Scheduled Castes/Tribes

10(26BB)Income of corporation for promoting the interests of members of minority community

10(26BBB)Income of corporation for welfare and economic upliftment of ex-servicemen

10(27)Income of a co-operative society formed for promoting the interests of members of Scheduled Castes/Tribes

10(28)Amount adjusted or paid in respect of tax credit certificates (Omitted)

10(29)Income of marketing authorities (Omitted)

10(29A)Income of specified Boards

10(30)Subsidy granted to the tea industry

10(31)Subsidies received by planters in respect of specified commodities

10(32)Specified income of minors includible under section 64(1A)

10(33)Income from transfer of units of Unit Scheme, 1964

10(34)Dividend income under section 115-O

10(34A)Income arising to an assessee on account of buy back of shares

10(35)Income from units of Mutual Funds

10(35A)Distributed income of an investor from securitisation trust

10(36)Long-term capital gains from equity shares

10(37)Capital gains from transfer of agricultural land

10(37A)Capital gains of transfer of a specified capital asset under Land Pooling Scheme

10(38)Long-term capital gains from transfer of equity shares or units of an equity oriented fund

10(39)Income of notified persons from any international sporting event held in India

10(40)Income of subsidiary company by way of grant from holding company engaged in power business

10(41)Income arising from transfer of a capital asset of an undertaking engaged in power business

10(42)Income of body/authority established under a bilateral treaty

10(43)Amount received by an individual as a loan in a reverse mortgage transaction

10(44)Income received by any person from New Pension System Trust

10(45)Allowance or perqusiite paid to Chairman/retired Chairman or member/retired member of UPSC [Omitted]

10(46)Specified income of statutory body or authority or Board or Trust

10(47)Income of an infrastructure debt fund

10(48)Income in Indian currency by a foreign company for sale of crude oil

10(48A)Income of Foreign company from storage and sale of crude oil stored as part of strategic reserves

10(48B)Income of Foreign Company from sale of leftover stock of crude oil from strategic reserves at the expiry of agreement or arrangement

10(48C)Income to the India Strategic Industry Development Board under an arrangement for replenishment of

10(48D)Income to an institution established for financing the infrastructure and development

10(48E)Income to a developmental financing institution, licensed by the RBI

10(49)Income of National Financial Holdings Company Limited

10(50)Income from specified service chargeable to equalisation levy

Volume 3

10A. Special provision in respect of newly established undertakings in free trade zone, etc.

10AA. Special provisions in respect of newly established units in Special Economic Zones

10B. Special provisions in respect of newly established hundred per cent export-oriented undertakings

10BA. Special provisions in respect of export of certain articles or things

10BB. Meaning of Computer programmes in certain cases

10C. Special provision in respect of certain industrial undertakings in North-Eastern Region

11. Income from property held for charitable or religious purposes

12. Income of trusts or institutions from contributions

12A. Conditions for applicability of sections 11 and 12

12AA. Procedure for registration

12AB. Procedure for fresh registration

13. Section 11 not to apply in certain cases

13A. Special provision relating to incomes of political parties

13B. Special provisions relating to voluntary contributions received by electoral trust

CHAPTER IV

Computation of Total Income

Heads of income

14. Heads of income

14A. Expenditure incurred in relation to income not includible in total income

A.—Salaries

15. Salaries

16. Deductions from salaries

17. “Salary”, “perquisite” and “profits in lieu of salary” defined

B.—Omitted by the Finance Act, 1988, w.e.f. 1-4-1989

[18 to 21. Omitted by the Finance Act, 1988, w.e.f. 1-4-1989]

C.—Income from house property

22. Income from house property

23. Annual value how determined

24. Deductions from income from house property

25. Amounts not deductible from income from house property

25A. Special provision for arrears of rent and unrealised rent received subsequently

25AA. Unrealised rent received subsequently to be charged to income-tax

25B. Special provision for arrears of rent received

26. Property owned by co-owners

27. “Owner of house property”, “annual charge”, etc., defined

D.—Profits and gains of business or profession

28. Profits and gains of business or profession

29. Income from profits and gains of business or profession, how computed

30. Rent, rates, taxes, repairs and insurance for buildings

31. Repairs and insurance of machinery, plant and furniture

32. Depreciation

32A. Investment allowance

32AB. Investment deposit account

32AC. Investment in new plant or machinery

32AD. Investment in new plant or machinery in notified backward areas in certain States

SUBJECT INDEX

Volume 4

D.—Profits & gains of business or profession

33. Development rebate

33A. Development allowance

33AB. Tea Development Account, Coffee Development Account and Rubber Development Account

33ABA. Site Restoration Fund

33AC. Reserves for shipping business

33B. Rehabilitation allowance

34. Conditions for depreciation allowance and development rebate

34A. Restriction on unabsorbed depreciation and unabsorbed investment allowance for limited period in case of certain domestic companies

35. Expenditure on scientific research

35A. Expenditure on acquisition of patent rights or copyrights

35AB. Expenditure on know-how

35ABA. Expenditure for obtaining right to use spectrum for telecommunication services

35ABB. Expenditure for obtaining licence to operate telecommunication services

35AC. Expenditure on eligible projects or schemes

35AD. Deduction in respect of expenditure on specified business

[35B. Omitted by the Direct Tax Laws (Amendment) Act, 1987, w.e.f. 1-4-1989]

[35C. Omitted by the Direct Tax Laws (Amendment) Act, 1987, w.e.f. 1-4-1989]

[35CC. Omitted by the Direct Tax Laws (Amendment) Act, 1987, w.e.f. 1-4-1989]

35CCA. Expenditure by way of payment to associations and institutions for carrying out rural development programmes

35CCB. Expenditure by way of payment to associations and institutions for carrying out programmes of conservation of natural resources

35CCC. Expenditure on agricultural extension project

35CCD. Expenditure on skill development project

35D. Amortisation of certain preliminary expenses

35DD. Amortisation of expenditure in case of amalgamation or demerger

35DDA. Amortisation of expenditure incurred under voluntary retirement scheme

35E. Deduction for expenditure on prospecting, etc., for certain minerals

36. Other deductions

37. General

38. Building, etc., partly used for business, etc., or not exclusively so used

[39. Omitted by the Direct Tax Laws (Amendment) Act, 1987, w.e.f. 1-4-1989]

40. Amounts not deductible

40A. Expenses or payments not deductible in certain circumstances

SUBJECT INDEX

Volume 5

41. Profits chargeable to tax

42. Special provision for deductions in the case of business for prospecting, etc., for mineral oil

43. Definitions of certain terms relevant to income from profits and gains of business or profession

43A. Special provisions consequential to changes in rate of exchange of currency

43AA. Taxation of foreign exchange fluctuation

43B. Certain deductions to be only on actual payment

43C. Special provision for computation of cost of acquisition of certain assets

43CA. Special provision for full value of consideration for transfer of assets other than capital assets in certain cases

43CB. Computation of income from construction and service contracts

43D. Special provision in case of income of public financial institutions, public companies, etc.

44. Insurance business

44A. Special provision for deduction in the case of trade, professional or similar association

44AA. Maintenance of accounts by certain persons carrying on profession or business

44AB. Audit of accounts of certain persons carrying on business or profession

[44AC. Omitted by the Finance Act, 1992, w.e.f. 1-4-1993]

44AD. Special provision for computing profits and gains of business on presumptive basis

44ADA. Special provision for computing profits and gains of profession on presumptive basis

44AE. Special provision for computing profits and gains of business of plying, hiring or leasing goods carriages

44AF. Special provisions for computing profits and gains of retail business

44B. Special provision for computing profits and gains of shipping business in the case of non-residents

44BB. Special provision for computing profits and gains in connection with the business of exploration, etc., of mineral oils

44BBA. Special provision for computing profits and gains of the business of operation of aircraft in the case of non-residents

44BBB. Special provision for computing profits and gains of foreign companies engaged in the business of civil construction, etc., in certain turnkey power projects

44C. Deduction of head office expenditure in the case of non-residents

44D. Special provisions for computing income by way of royalties, etc., in the case of foreign companies

44DA. Special provision for computing income by way of royalties, etc., in case of non-residents

44DB. Special provision for computing deductions in the case of business reorganisation of co-operative banks

E.—Capital gains

45. Capital gains

46. Capital gains on distribution of assets by companies in liquidation

46A. Capital gains on purchase by company of its own shares or other specified securities

47. Transactions not regarded as transfer

47A. Withdrawal of exemption in certain cases

48. Mode of computation

49. Cost with reference to certain modes of acquisition

50. Special provision for computation of capital gains in case of depreciable assets

50A. Special provision for cost of acquisition in case of depreciable asset

50B. Special provision for computation of capital gains in case of slump sale

50C. Special provision for full value of consideration in certain cases

50CA. Special provision for full value of consideration for transfer of share other than quoted share

50D. Fair market value deemed to be full value of consideration in certain cases

51. Advance money received

[52. Omitted by the Finance Act, 1987, w.e.f. 1-4-1988]

[53. Omitted by the Finance Act, 1992, w.e.f. 1-4-1993]

54. Profit on sale of property used for residence

[54A. Omitted by the Finance (No. 2) Act, 1971, w.e.f. 1-4-1972]

54B. Capital gain on transfer of land used for agricultural purposes not to be charged in certain cases

[54C. Omitted by the Finance Act, 1976, w.e.f. 1-4-1976]

54D. Capital gain on compulsory acquisition of lands and buildings not to be charged in certain cases

54E. Capital gain on transfer of capital assets not to be charged in certain cases

54EA. Capital gain on transfer of long-term capital assets not to be charged in the case of investment in specified securities

54EB. Capital gain on transfer of long-term capital assets not to be charged in certain cases

54EC. Capital gain not to be charged on investment in certain bonds

54ED. Capital gain on transfer of certain listed securities or unit, not to be charged in certain cases

54EE. Capital gain not to be charged on investment in units of a specified fund

54F. Capital gain on transfer of certain capital assets not to be charged in case of investment in residential house

54G. Exemption of capital gains on transfer of assets in cases of shifting of industrial undertaking from urban area

54GA. Exemption of capital gains on transfer of assets in cases of shifting of industrial undertaking from urban area to any Special Economic Zone

54GB. Capital gain on transfer of residential property not to be charged in certain cases

54H. Extension of time for acquiring new asset or depositing or investing amount of capital gain

55. Meaning of “adjusted”, “cost of improvement” and “cost of acquisition”

55A. Reference to Valuation Officer

F.—Income from other sources

56. Income from other sources

57. Deductions

58. Amounts not deductible

59. Profits chargeable to tax

CHAPTER V

INCOME OF OTHER PERSONS, INCLUDED IN ASSESSEE’S TOTAL INCOME

60. Transfer of income where there is no transfer of assets

61. Revocable transfer of assets

62. Transfer irrevocable for a specified period

63. “Transfer” and “revocable transfer” defined

64. Income of individual to include income of spouse, minor child, etc.

65. Liability of person in respect of income included in the income of another person

CHAPTER VI

AGGREGATION OF INCOME AND SET OFF OR CARRY FORWARD OF LOSS

Aggregation of income

66. Total income

[67. Omitted by the Finance Act, 1992, w.e.f. 1-4-1993]

67A. Method of computing a member’s share in income of association of persons or body of individuals

68. Cash credits

69. Unexplained investments

69A. Unexplained money, etc.

69B. Amount of investments, etc., not fully disclosed in books of account

69C. Unexplained expenditure, etc.

69D. Amount borrowed or repaid on hundi

SUBJECT INDEX

Details :

- Publisher : Bharat Law House Pvt. Ltd.

- Author : Sampath Iyengar Revised by H. Padamchand Khincha and Chythanya K.K

- Edition : 13th Edition 2024

- ISBN-13 : 9789393749871

- ISBN-10 : 9789393749871

- Language : English

- Binding : Hardcover

| Publisher | |

|---|---|

| Language | |

| Author |

Be the first to review “Bharat’s Law of Income Tax (Volume 1 to 9) By Sampath Iyengar – 13th Edition 2024” Cancel reply

Related products

Direct Tax

Commercial’s Direct Taxes Law & Practice (Professional) By Dr Girish Ahuja & Dr Ravi Gupta

Reviews

There are no reviews yet.