-

×

-

×

KP's Women and the Constitution by Nayan Joshi

2 × ₹440.00 -

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

Nabhi’s Income Tax Guidelines & Mini Ready Reckoner 2024-25 & 2025-26

1 × ₹801.00 -

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

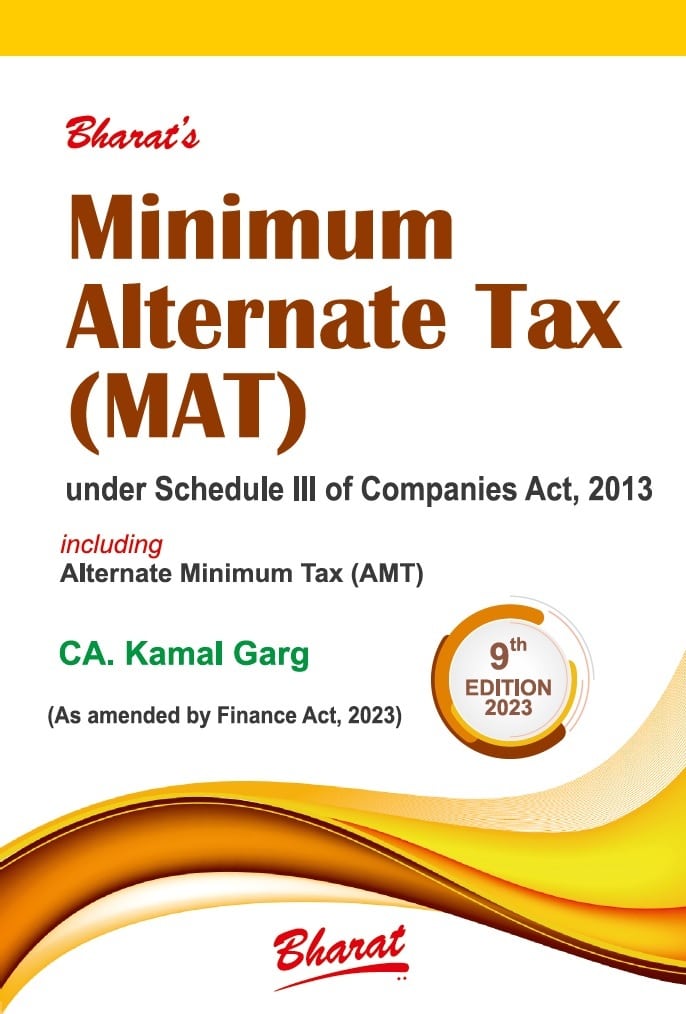

Bharat’s Minimum Alternative Tax (MAT) under Schedule III of Companies Act, 2013 including Alternate Minimum Tax (AMT) by CA. Kamal Garg – 9th Edition 2023

₹1,195.00 Original price was: ₹1,195.00.₹896.00Current price is: ₹896.00.

Bharat’s Minimum Alternative Tax (MAT) under Schedule III of Companies Act, 2013 including Alternate Minimum Tax (AMT) by CA. Kamal Garg – 9th Edition 2023.

10 in stock

SKU: Bharat's Minimum Alternative Tax (MAT) under Schedule III of Companies Act, 2013 including Alternate Minimum Tax (AMT) by CA. Kamal Garg - 9th Edition 2023

Categories: Minimum Alternative Tax (MAT), Professional Books

Tag: Minimum Alternative Tax (MAT)

Bharat’s Minimum Alternative Tax (MAT) under Schedule III of Companies Act, 2013 including Alternate Minimum Tax (AMT) by CA. Kamal Garg – 9th Edition 2023.

Bharat’s Minimum Alternative Tax (MAT) under Schedule III of Companies Act, 2013 including Alternate Minimum Tax (AMT) by CA. Kamal Garg – 9th Edition 2023.

About Minimum Alternative Tax (MAT) under Schedule III of Companies Act, 2013 including Alternate Minimum Tax (AMT)

Chapter 1 Minimum Alternate Tax (MAT) — An Introduction

Chapter 2 Net Profit as per Profit and Loss Account

Chapter 3 Income Tax Paid/Payable/Provision for Income Tax

Chapter 4 Amounts Carried to Reserves

Chapter 5 Unascertained Liabilities

Chapter 6 Provision for Losses of Subsidiary Companies

Chapter 7 Dividends paid or proposed

Chapter 8 Tax Free Incomes and Expenditures Related to them

Chapter 9 Expenditure Relatable to Share of Income in AOP/BOI

Chapter 10 Expenditure relatable to Foreign Company’s Income Taxable at less than MAT rate

Chapter 11 Notional Loss of Sponsors of REITS and INVITS on Exchange of Shares in SPV for Units of REIT/INVIT or Due to Change in Value of Units or Loss on Transfer of Units

Chapter 12 Expenditure Relatable to Resident Company’s Royalty Income from Patents Chargeable to tax u/s 115BBF @ 10% (i.e. at less than MAT rate)

Chapter 13 Amount of Depreciation and Revaluation Reserve in Respect of Asset Retired/Disposed Off

Chapter 14 Withdrawals from Reserves or Provisions

Chapter 15 Loss Brought Forward or Unabsorbed Depreciation

Chapter 16 Profits of a Sick Industrial Company

Chapter 17 FAQs under MAT

Chapter 18 Rationalisation of provisions of section 115JB in line with Indian Accounting Standard (Ind-AS)

Appendix 1 Indian Accounting Standard (Ind AS) 101: First-time Adoption of Indian Accounting Standards

Chapter 19 Format of Financial Statements for Companies (Other than NBFCs) required to comply with Ind-AS under Companies Act, 2013 — Division II of Schedule III

Chapter 20 FAQs on Schedule III under Companies Act, 2013

Chapter 21 Ind AS Financials Format — A Comparison with AS Financials Format

Chapter 22 Significant Accounting Standards pertinent to MAT under Income Tax Act, 1961

Chapter 23 Accounting Treatment for MAT Credit

Chapter 24 Special Provisions Relating to Certain Limited Liability Partnerships (LLP)

Chapter 25 Alternate Minimum Tax (AMT) on all persons other than companies [Section 115JC to 115JF Chapter XIIBA]

Chapter 26 Significant Judgments on MAT

Chapter 27 Levy of MAT on FIIs

Chapter 28 Illustrations on MAT

Chapter 29 Draft guidelines for computation of book profit by Ind AS Compliant Companies

Appendix 1 Relevant Statutory Provisions

Appendix 2 Rule 40B with Form 29B

Appendix 3 Sections 115JC to 115JF

Appendix 4 Rule 40BA with Form 29C

Appendix 5 Schedule III of Companies Act, 2013

Appendix 6 Schedule II of Companies Act, 2013

Details :

- Publisher : Bharat Law House Pvt. Ltd.

- Author : CA. Kamal Garg

- Edition : 9th Edition 2023

- ISBN-13 : 9788196260552

- ISBN-10 : 9788196260552

- Pages : 616 pages

- Language : English

- Binding : Paperback

| Language | |

|---|---|

| Author | |

| Publisher |

Be the first to review “Bharat’s Minimum Alternative Tax (MAT) under Schedule III of Companies Act, 2013 including Alternate Minimum Tax (AMT) by CA. Kamal Garg – 9th Edition 2023” Cancel reply

Related products

25% Off

25% Off

25% Off

17% Off

25% Off

15% Off

25% Off

KP's Women and the Constitution by Nayan Joshi

KP's Women and the Constitution by Nayan Joshi

Nabhi’s Income Tax Guidelines & Mini Ready Reckoner 2024-25 & 2025-26

Nabhi’s Income Tax Guidelines & Mini Ready Reckoner 2024-25 & 2025-26

Reviews

There are no reviews yet.