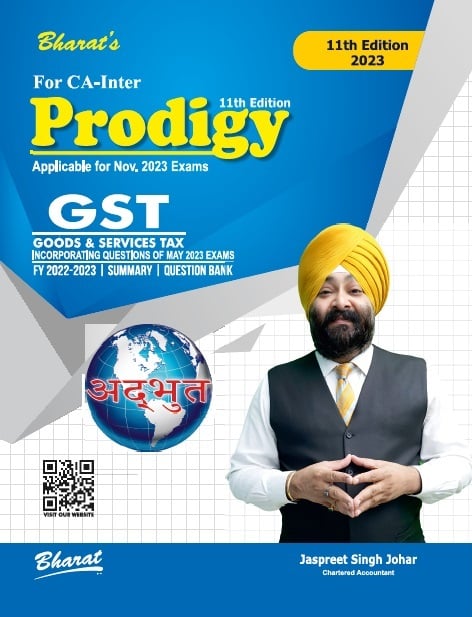

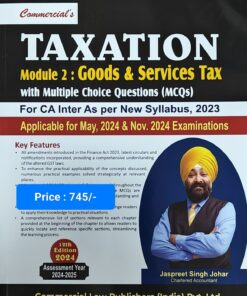

Bharat’s Prodigy of Goods & Services Tax (GST) by Jassprit S Johar

₹480.00 Original price was: ₹480.00.₹398.00Current price is: ₹398.00.

Bharat’s Goods & Services Tax (GST) by Jassprit S Johar for Nov 2023 Exam – 11th Edition 2023.

10 in stock

Bharat’s Goods & Services Tax (GST) by Jassprit S Johar for Nov 2023 Exam – 11th Edition 2023.

Bharat’s Goods & Services Tax (GST) by Jassprit S Johar for Nov 2023 Exam – 11th Edition 2023.

About Prodigy of Goods & Services Tax (GST) (Summary & Solved Examination Questions) for CA Inter

1 Basic Introduction to Goods and Services Tax (GST)

2 Chargeability under CGST and IGST

3 Registration under GST

4 Supply under GST

5 Exemptions under GST

6 Value of Supply under GST Section 15 of CGST Act, 2017

7 Composition Scheme – Section 10/Rule 3-7 of CGST Rules, 2017

8 Invoice under GST Section 31 to 34 of CGST Act, 2017 & Section 20 of IGST Act, 2017 Tax Invoice, Credit and Debit Notes of CGST Rules, 2017

9 Time of Supply under GST – Section 12/13/14

10 Provisions relating to E-way Bill – Section 68 of CGST Act & Rule 138

11 Filing of Return under GST – Section 37 to 48 of CGST Act, 2017/ Rules 59 to 84 of CGST Rules, 2017

12 Input Tax Credit under GST – Sections 16, 17, 18, Rules 36-44

13 Payment of GST – Sections 49, 50 and Rules 85, 86, 87, 88

Details :

- Publisher : Bharat Law House Pvt. Ltd.

- Author : Jassprit S Johar

- Edition : 11th Edition 2023

- ISBN-13 : 9788196363147

- ISBN-10 : 9788196363147

- Pages : 336 pages

- Language : English

- Binding : Paperback

| Publisher | |

|---|---|

| Language | |

| Author |

Be the first to review “Bharat’s Prodigy of Goods & Services Tax (GST) by Jassprit S Johar” Cancel reply

Related products

Financial Reporting

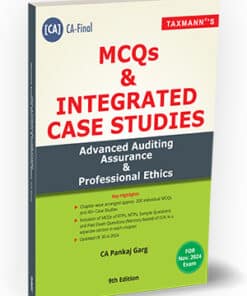

Auditing and Assurance

Taxmann’s Auditing & Assurance by Pankaj Garg for Nov 2023 Exams

Direct Tax Laws & International Taxation

Indirect Tax Laws

Advanced Auditing and Professional Ethics

Reviews

There are no reviews yet.