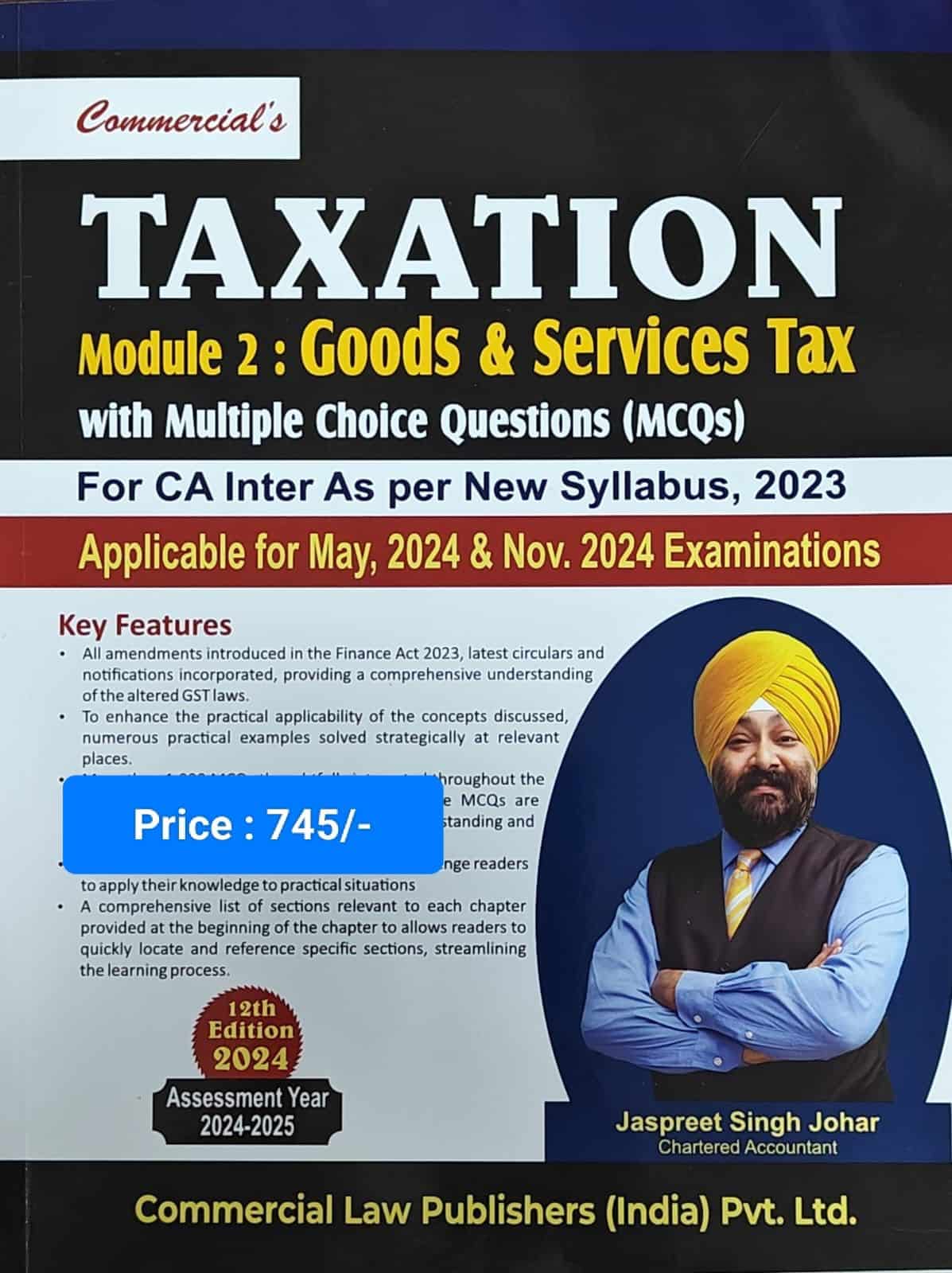

Commercial’s Taxation (Module-II: GST) (CA Inter — New) by Jassprit S Johar

₹745.00 Original price was: ₹745.00.₹633.00Current price is: ₹633.00.

Commercial’s Taxation (Module-II: GST) (CA Intermediate — New Course) by Jassprit S Johar for May 2024 Exam – 12th Edition 2024.

10 in stock

Commercial’s Taxation (Module-II: GST) (CA Intermediate — New Course) by Jassprit S Johar for May 2024 Exam – 12th Edition 2024.

Commercial’s Taxation (Module-II: GST) (CA Intermediate — New Course) by Jassprit S Johar for May 2024 Exam – 12th Edition 2024.

About TAXATION (Module-II: GST)

Chapter 1 Basic Introduction to Goods and Services Tax (GST)

MCQs

Chapter 2 Chargeability under CGST and IGST

MCQs

Chapter 3 Registration under GST (Section 22 to 30/Rule 8-26 of CGST Rules, 2017)

Annexure: State Codes for GSTIN

MCQs

Chapter 4 Supply under GST

Extra Questions

MCQs

Chapter 5 Exemptions under GST

Extra Questions

MCQs

Chapter 6 Value of Supply under GST

Extra Points

Extra Questions

MCQs

Chapter 7 Composition Scheme (Section 10/Rule 3-7 of CGST Rules, 2017)

Extra Questions

MCQs

Chapter 8 Input Tax Credit under GST (Sections 16, 17, 18)

MCQs

Chapter 9 Time of Supply Under GST

Extra Questions

MCQs

Chapter 10 Payment of GST (Sections 49, 50 and Rules 85, 86, 87, 88)

MCQs

Chapter 11 Invoice under GST (Section 31 to 34 of CGST Act, 2017 & Section 20 of IGST Act, 2017)

Extra Questions

MCQs

Chapter 12 Provisions Relating To E-Way Bill (Section 68 and Rule 138)

MCQs

Chapter 13 Filing of Return under GST (Section 37 to 48 of CGST Act, 2017/Rules 59 to 84 of CGST Rules, 2017)

MCQs

Chapter 14 Multiple Choice Questions of Goods and Services Tax

Details :

- Publisher : Commercial Law Publishers (India) Pvt. Ltd.

- Author : Jassprit S Johar

- Edition : 12th Edition 2024

- ISBN-13 : 9789356039933

- ISBN-10 : 9789356039933

- Language : English

- Binding : Paperback

| Publisher | |

|---|---|

| Author | |

| Language |

Be the first to review “Commercial’s Taxation (Module-II: GST) (CA Inter — New) by Jassprit S Johar” Cancel reply

Related products

Setting up of Business Entities and Closure

Taxmann’s Setting up of Business Entities & Closure by N.S Zad for June 2023

Advanced Auditing and Professional Ethics

Setting up of Business Entities and Closure

Taxmann’s Cracker – Setting up of Business Entities & Closure by N.S Zad for June 2024

Auditing and Assurance

Taxmann’s Auditing & Assurance by Pankaj Garg for Nov 2023 Exams

Financial Reporting

Taxmann’s Student’s Guide To Ind ASs [Converged IFRSs] by Dr. D.S. Rawat for Nov 2023

![Taxmann's Student's Guide To Ind ASs [Converged IFRSs] by Dr. D.S. Rawat for Nov 2023](https://v2t4u7x3.rocketcdn.me/wp-content/uploads/2022/12/9789357780711-247x296.jpg)

Reviews

There are no reviews yet.