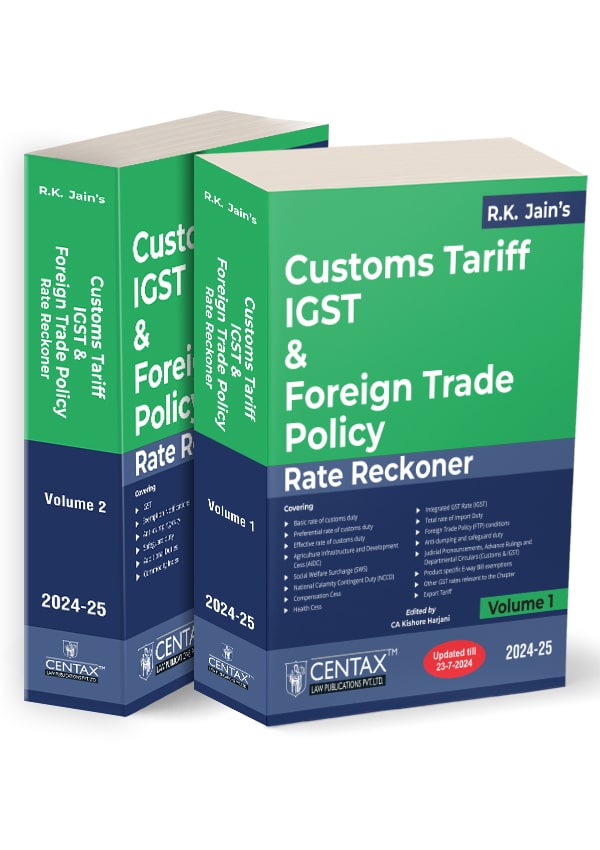

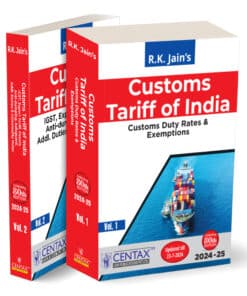

- Publisher : Centax Publication

- Author : R.K. Jain

- Edition : 1st Edition July 2024

- Language : English

- ISBN-10 : 9789391055776

- ISBN-13 : 9789391055776

Centax’s Customs Tariff, IGST & Foreign Trade Policy Rate Reckoner by R.K. Jain – Edition 2024-25

₹4,495.00 Original price was: ₹4,495.00.₹3,731.00Current price is: ₹3,731.00.

Centax’s Customs Tariff, IGST & Foreign Trade Policy Rate Reckoner (Set of 2 Volumes) by R.K. Jain – Edition 2024-25. This book is an essential reference for Customs, GST, and EXIM regulations, providing comprehensive details to determine the total duty payable on the import of goods into India. Each HSN entry includes up to 13 columns detailing various duty rates, cess, and policy conditions. It features detailed computations, final rate calculations, and references to anti-dumping duties, exemption notifications, ad valorem rates, and landmark rulings & departmental circulars under both customs and GST. This consolidated resource ensures accurate duty assessment and compliance with customs and GST regulations.

10 in stock

Centax’s Customs Tariff, IGST & Foreign Trade Policy Rate Reckoner (Set of 2 Volumes) by R.K. Jain – Edition 2024-25.

Centax’s Customs Tariff, IGST & Foreign Trade Policy Rate Reckoner (Set of 2 Volumes) by R.K. Jain – Edition 2024-25.

CONTENT

This book is an essential reference guide for those dealing with customs, GST, and EXIM regulations. It benefits customs officials, GST practitioners, importers and exporters, tax professionals, legal advisors, policymakers, and researchers.

Each chapter is structured to ensure that all necessary details are easily accessible to arrive at the—’total duty payable on import of goods’ into India. Each HSN entry features up to 13 columns detailing the following:

- Basic rate of customs duty

- Preferential rate of customs duty

- The effective rate of customs duty

- Agriculture Infrastructure and Development Cess (AIDC)

- Social Welfare Surcharge (SWS)

- National Calamity Contingent Duty (NCCD)

- Health Cess

- Integrated GST Rate (IGST)

- Total rate

- Foreign Trade Policy (FTP) for import

- Conditions in FTP for import

The Present Publication is the 2024-25 Edition, amended by the Finance (No. 2) Bill 2024 and updated till 23rd July 2024. It is edited by CA. Kishore Harjani and incorporates the following noteworthy features:

- [HSN-wise Computation] – Detailed computation of total customs duty aligned with each HSN, including descriptions and units. Exemptions, additional duties, and FTP conditions are mapped to each HSN for comprehensive information on a single page.

- [Final Rate Calculation] – The ‘Total Customs Duty’ column provides the final rate, streamlining the evaluation of multiple exemptions or additional duty notifications. Where the final rate cannot be computed due to specific exemptions or duties, relevant details are included in the footnotes

- [Anti-Dumping and Countervailing Duties] – Includes chapter-wise references to anti-dumping, safeguard, and countervailing duties for better understanding of trade protection measures

- [Exemption Notifications] – Lists general and chapter-specific exemption notifications at the end of each chapter for thorough coverage

- [Ad Valorem Rates] – Presents ad valorem rates in percentage terms for straightforward calculation of customs duties

- [Multiple Rates] – Provides dual rates of ‘Total Customs Duty’ and ‘IGST Rate’ for products within each HSN that may be subject to two or more IGST rates, ensuring accurate duty assessment

- [Comprehensive Circulars/Notifications] – Exhaustive coverage of chapter-specific circulars, notifications, and advance ruling orders for customs and GST

- [Landmark Rulings] – Includes a chapter-specific digest of case laws on Customs and GST for quick access to judicial precedents on classification issues

- [Base Notifications Reference] – Offers chapter-specific references to all base notifications related to customs and GST

- [E-Way Bill Exemptions] – Highlights chapter-wise exemptions from e-way bill at the end of each chapter

- [One-Stop Reference] – Consolidated resource for customs, GST, and policy conditions governing the import and export of goods

- [No Alteration in HSN] – Mapping of exemptions, GST rates, and cess is done with customs tariffs seamlessly, without altering the HSN description

- [Expert Validation] – A panel of subject matter experts has vetted the computation and mapping of notifications with the HSN

The structure of the book is as follows:

- Beginning of the Section/Chapter

- Section and Chapter Notes

- General and specific exemption notifications relevant to the Chapter

- Tariff Table – The tariff table contains tariff classification-wise mapping of:

- Basic duty rate

- Preferential rate, wherever applicable

- Effective duty rate (post-factoring general and specific exemptions)

- Additional levies (e.g., AIDC, Health Cess, etc.)

- SWS

- IGST Rates

- Total duty

- Policy Restrictions

- Exemptions under Customs and GST

- Beginning of the Chapter – General and specific exemptions applicable to the chapter are mentioned at the beginning of each chapter

- Product-wise and HSN-wise – Specific exemptions applicable to the products within the chapter are captured at the HSN level

- Footnotes – Exemptions that are chapter-wise or at the two to six-digit HSN level are mentioned via footnotes

- Footnotes

- Duty rates or exemptions that are chapter-wise or at the two to six-digit HSN level are mentioned via footnotes

- End of Chapter

- Anti-dumping and Safeguard Duty rates relevant to the Chapter

- Customs exemptions relevant to the Chapter

- Judicial Pronouncements, Advance Rulings, and Departmental Clarifications relevant to the Chapter

- Product-Specific E-Way Bill Exemptions relevant to the Chapter

- Other GST Rates relevant to the Chapter

The Tariff is divided into nine parts, comprising two volumes:

- Volume 1

- Part 1 – Customs Tariff Act, 1975 (Text)

- Part 2 – Import Tariff – First Schedule (98 Chapters in 21 sections),

- Part 2A – Export Tariff – Second Schedule

- Volume 2

- Part 3 – Customs Exemptions

- Part 4 – IGST – Integrated Goods and Services Tax (Extracts, Rules, Rates & Exemptions, notifications, and Introduction)

- Part 5 – Annexures (Compensation Cess, Road and Infrastructure Cess, Social Welfare Surcharge, NCCD, Health and Other Cess, Additional Duty, Special Duty & Baggage Rules)

- Part 6 – Rules for Safeguard Duty and Notifications Imposing Safeguard Duty

- Part 7 – Rules for Anti-Dumping and Countervailing Duties and Notifications imposing Anti-Dumping Duty and Countervailing Duty

- Part 8 – Commodity Index and Chronological List of Basic Notifications

The book includes detailed sections such as:

- Customs Tariff (Determination of Origin of Other Preferential Areas) Rules, 1977 and relevant notifications

- Rules of Determination of Origin of Goods under various trade agreements (Asia-Pacific Trade Agreement, SAARC Preferential Trading Arrangement, India-Sri Lanka Free Trade Agreement, etc.)

- Customs Tariff Rules under bilateral agreements (with countries like Afghanistan, Thailand, Singapore, Chile, MERCOSUR, Korea, ASEAN, Malaysia, Japan, Mauritius, UAE, and Australia)

- Validating Provisions & Notifications related to Customs Tariff

- Safeguard Duty Rules and Notifications

- Anti-Dumping and Countervailing Duty Rules and Notifications

- Miscellaneous sections, including Commodity Index and Chronological List of Basic Notifications.

About the author

Sh. R.K. Jain, the renowned author of Indirect Taxes including Customs, Central Excise, Service Tax, Foreign Trade Policy (FTP), GST and FEMA. He made his debut in the early seventies, and in the year 1975, he brought out Customs & Excise Tariffs and Manuals, which have recently celebrated Silver/ Golden Jubilee Editions.

Excise Law Times (E.L.T.) edited by Sh. R.K. Jain was launched nearly 45 years ago, and it brought awakening in the field of Central Excise and Customs. It has grown to be the prime journal with the largest circulation.

Another Journal, ‘Service Tax Review’, was started in 2006, and finally, R.K. Jain’s GST Law Times was introduced in 2017, after the advent of GST, the major Indirect Tax Reform. EXCUS is the digital version of these Journals.

Details

| Publisher | |

|---|---|

| Author | |

| Language |

Be the first to review “Centax’s Customs Tariff, IGST & Foreign Trade Policy Rate Reckoner by R.K. Jain – Edition 2024-25” Cancel reply

Related products

MSME

Bloomsbury’s Treatise on Micro, Small and Medium Enterprises by Rajeev Babel – 1st Edition June 2021

Direct Tax

Commercial’s Direct Taxes Law & Practice (Professional) By Dr Girish Ahuja & Dr Ravi Gupta

Reviews

There are no reviews yet.