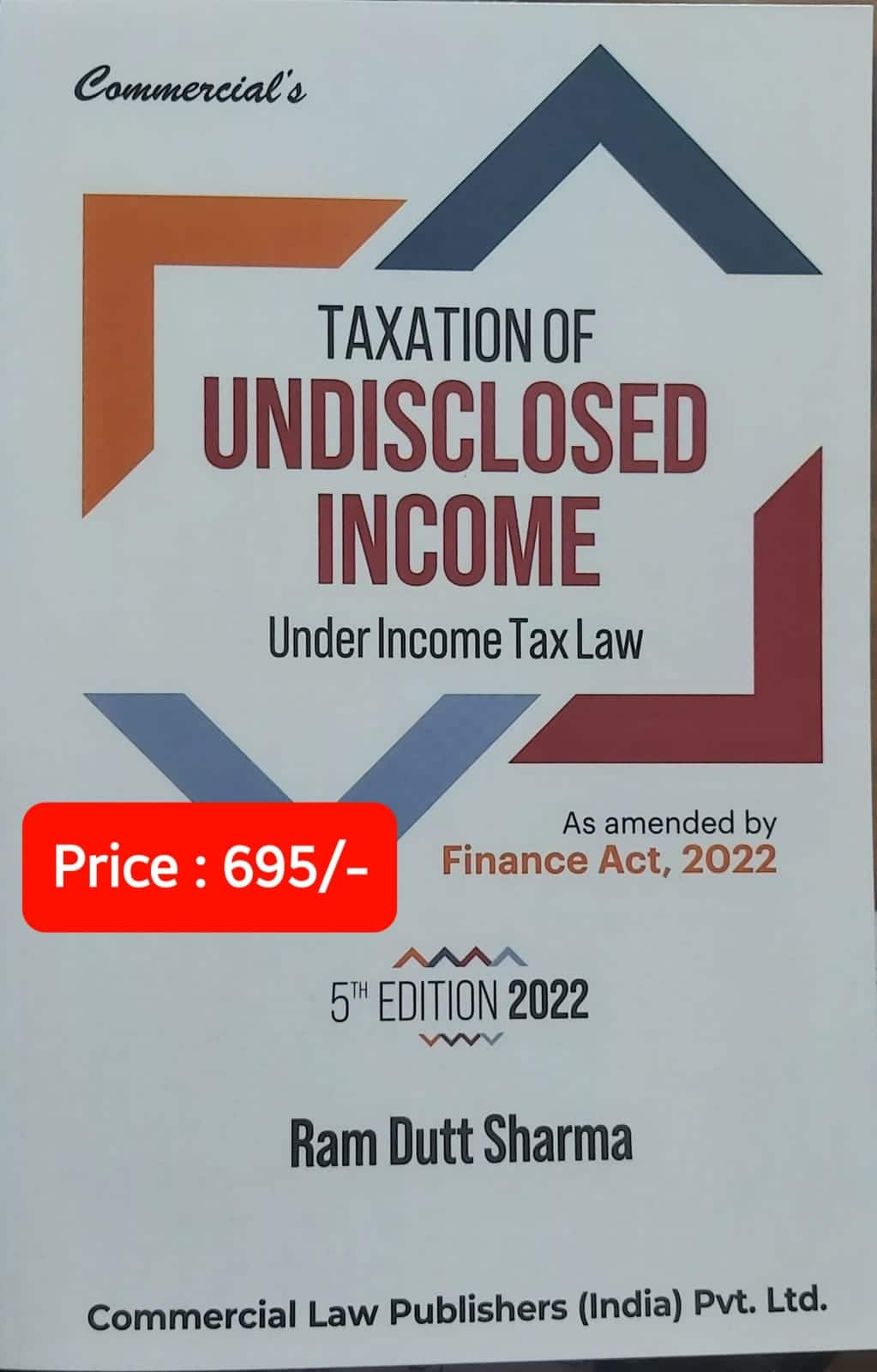

- Publisher : Commercial Law Publishers (India) Pvt. Ltd.

- Author : Ram Dutt Sharma

- Edition : 5th Edition 2022

- ISBN-13 : 9789356030763

- ISBN-10 : 9789356030763

- Language : English

- Binding : Paperback

Commercial’s Taxation of Undisclosed Income Under Income Tax Law by Ram Dutt Sharma

₹695.00 Original price was: ₹695.00.₹521.00Current price is: ₹521.00.

Commercial’s Taxation of Undisclosed Income Under Income Tax Law – As Amended by Finance Act, 2022 by Ram Dutt Sharma – 5th Edition 2022.

9 in stock

Commercial’s Taxation of Undisclosed Income Under Income Tax Law – As Amended by Finance Act, 2022 by Ram Dutt Sharma – 5th Edition 2022.

Commercial’s Taxation of Undisclosed Income Under Income Tax Law – As Amended by Finance Act, 2022 by Ram Dutt Sharma – 5th Edition 2022.

About the book

In the recent years, probably no economic issue has covered more space than Black Money. The unaccounted income commonly spoken as black money is income from the parallel economy and is known by different names: informal, unofficial, irregular, second, underground, subterranean, hidden, invisible, unrecorded or shadow economy. The unaccounted or black economy means different things to different people.

This Book aims at discussing tax treatment of all sorts of incomes from undisclosed sources. The whole book has been devised with the objective of providing a thorough and analytical study of the provisions which are generally sought to be invoked by tax authorities at the time of carrying out a scrutiny assessment or while completing the assessment in pursuance of a search or survey under the Income Tax Act, 1961.

Undisclosed income is the income which the assessee has not shown in the Income Tax Return and thereby not paid income tax on it. The primary objective of the Income-tax Department is to detect such undisclosed income and bring the same under the tax net.

The unaccounted income commonly spoken as black money is known by different names informal, unofficial, irregular, second, underground, subterranean, hidden, invisible, unrecorded or shadow economy. Unaccounted income is a multi dimensional phenomenon and its definition would depend on the context in which it is being used.

If the Assessing Officer detects cash credits, unexplained investments, unexplained expenditure etc, the source for which is not satisfactorily explained by the assessee to him, there are various provisions in the Income Tax Act which empower the assessing officer to charge tax on such amount.

Apart from cash credit some other deeming provisions dealing with income from undisclosed sources, are contained in sections 68, 69, 69A, 69B, 69C and 69D. Direct or indirect use of unaccounted income is also involved intended to be covered via these deeming provisions.

Unaccounted income is also brought into the books of account in the form of loans and deposits. Huge black money is also involved in immovable property related transactions. The Government has introduced several measures under the Income Tax Act with the aim of curbing flow of black money in the society.

Apart from incorporation of amended statutory provisions, the lot of important judicial pronouncements have been included in this book.

We feel that this book of ours will be useful for one and all concerned with tax practitioners, tax administrators and other concerned as the subject-matter covered herein is one which is of day-to-day relevance. The treatment is exhaustive enough aimed at meeting totality of the requirements in regard to taxation of undisclosed income of all sorts, together with their consequential implications.

I would like to place on record a special note of gratitude to Shri Ashok Kumar Manchanda, IRS, (1976 – Batch) who has been the guiding force and a constant source of inspiration in my life I also express my thanks to Commercial Law Publishers (India) Pvt. Ltd. who reposed confidence in me and published this book. They have done a good job in making this book attractive, acceptable and useful. Although, every effort has been made to support every information given in the book with the relevant sections and the rules of law, however, the book should not be construed as an exhaustive statement of law. The relevant provisions of the Income Tax Act and the Income Tax Rules, may be referred to, if necessary. Though every care has been taken to provide authentic information yet the author/ publisher are not legally or morally responsible for any loss or damage that may arise to any person from an inadvertent error or omission in the book.

I am sure this ready book will be of immense practical value to tax authorities, tax practitioners, and the general public . I, however, always welcome suggestions and criticism from our esteemed readers for further improvement of the future editions of the book.

Details :-

| Publisher | |

|---|---|

| Author | |

| Language |

Be the first to review “Commercial’s Taxation of Undisclosed Income Under Income Tax Law by Ram Dutt Sharma” Cancel reply

Related products

Direct Tax

Commercial’s Direct Taxes Law & Practice (Professional) By Dr Girish Ahuja & Dr Ravi Gupta

MSME

Bloomsbury’s Treatise on Micro, Small and Medium Enterprises by Rajeev Babel – 1st Edition June 2021

International Taxation

Reviews

There are no reviews yet.