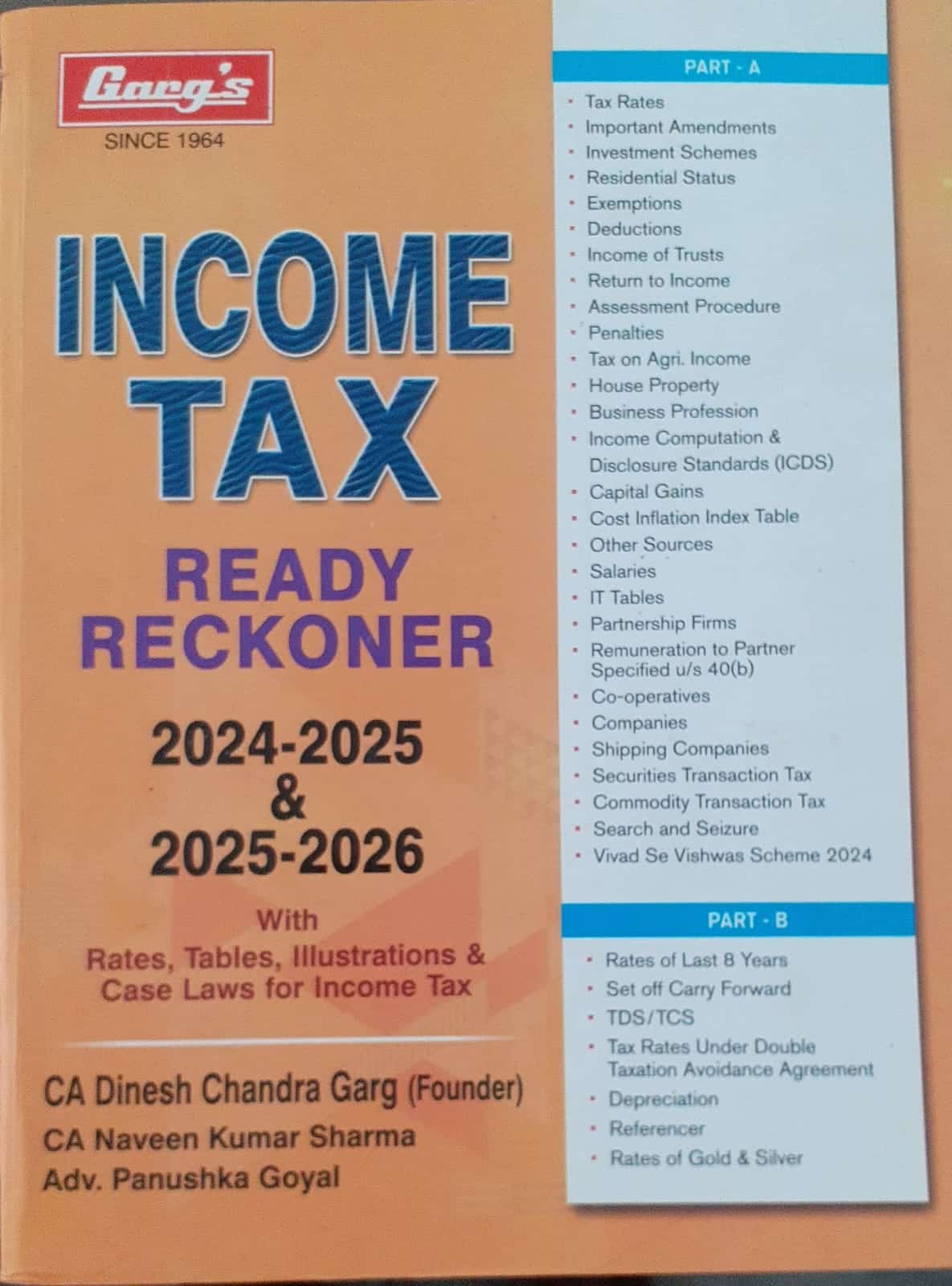

Garg’s Income Tax Ready Reckoner for Assessment Year 2024-2025 & 2025-2026

₹2,375.00 Original price was: ₹2,375.00.₹1,781.00Current price is: ₹1,781.00.

Garg’s Income Tax Ready Reckoner for Assessment Year 2024-2025 & 2025-2026.

17 in stock

Garg’s Income Tax Ready Reckoner for Assessment Year 2024-2025 & 2025-2026.

Garg’s Income Tax Ready Reckoner for Assessment Year 2024-2025 & 2025-2026.

Description:-

Garg’s Income Tax Ready Reckoner for Assessment Year 2024-2025 & 2025-2026.

INDEX : –

1 RATES OF TAX

2 IMPORTANT AMENDMENTS

3 TAX SAVING – CUM INVESTMENT SCHEMES

4 TAX OBLIGATIONS WITH PRESCRIBED FORMS

5 RESIDENTIAL STATUS

6 INCOME WHICH DO NOT FORM PART OF TOTAL INCOME

7 INCOME OF OTHER PERSONS INCLUDED IN ASSESSEE’S TOTAL INCOME

8 DEDUCTIONS UNDER CHAPTER VIA

9 MISCELLANEOUS

10 INCOME FROM HOUSE PROPERTY

11 PROFITS AND GAINS OF BUSINESS OR PROFESSION

12 INCOME COMPUTATION AND DIXCLOSURE STANDARDS

13 CAPITAL GAINS

15 INCOME TAX ON PARTNERSHIP FIRMS

16 LIMITED LIABILITY PARTNERSHIP

17 INCOME TAX ON CO – OPERATIVE SOCIETIES

18 INCOME TAX ON COMPANIES

19 SPECIAL PROVISION RELATING TO INCOME OF SHIPPING COMPANIES

20 SECURITIES TRANSACTION TAX

21 COMMODITIES TRANSACTION TAX

22 SEARCH & SEIZURE

PART B

1 WEALTH TAX

2 RATES OF LAST EIGHT YEARS

3 SET OFF AND CARRY FORWARD OF LOSSES

4. TAX DEDUCTION COLLECTION SOURECE

4 TAX RATES FOR FOREIGNERS TREATIES

6 DEPRECIATION AND RATES UNDER INCOME TAX ACT AND COMPANIES ACT 2013

7 REFERENCER

Details :

- Publisher : LMH Publications

- Author : Sandeep Garg

- Edition : August 2024

- ISBN-13 : 9788195827992

- ISBN-10 : 9788195827992

- Language : English

- Binding : Paperback

| Publisher | |

|---|---|

| Language | |

| Author |

Be the first to review “Garg’s Income Tax Ready Reckoner for Assessment Year 2024-2025 & 2025-2026” Cancel reply

Related products

Income Tax

Commercial’s Filing of Indian Income Tax Updated Return by Ram Dutt Sharma – Edition 2023

Reviews

There are no reviews yet.