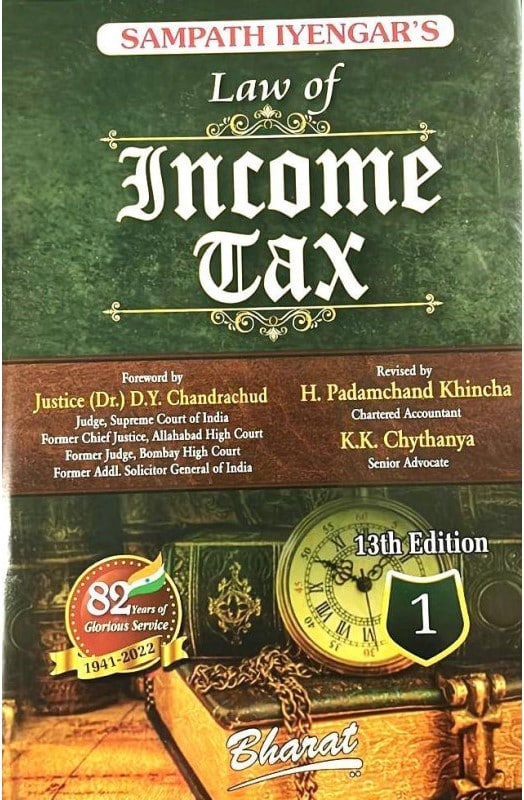

Bharat’s Law of Income Tax (Volume 1) By Sampath Iyengar – 13th Edition 2024

₹2,995.00 Original price was: ₹2,995.00.₹2,546.00Current price is: ₹2,546.00.

Bharat’s Law of Income Tax (Volume 1) By Sampath Iyengar – 13th Edition 2024.

9 in stock

Bharat’s Law of Income Tax (Volume 1) By Sampath Iyengar – 13th Edition 2024.

Bharat’s Law of Income Tax (Volume 1) By Sampath Iyengar – 13th Edition 2024.

About Law of Income Tax (Volume 1) By Sampath Iyengar

Sampath Iyengar’s Law of Income Tax has maintained its reputation as a commentary, exhaustive and encyclopedic in its sweep, and as a veritable warehouse of all the available information on the subject, besides carrying critical and in-depth comments. It is the most authentic referencer, which has stood the test of time during the last eight decades and has retained its pristine glory. This set provides not only the necessary access to all the relevant information, but also the expertise and the experience of the authors, present and past. Conflicting views are highlighted. Precedents are not merely listed, but their rationale analysed. This book has always been different in not being content with mere listing of cases, but by providing enough material to tackle any problem that may arise. No wonder it is being referred and cited as an authority at all levels of judicial interpretation – Income-tax Department, ITAT, High Courts, Supreme Court and even Authority for Advance Rulings.

While India celebrates its 75 years of Independence, Sampath Iyengar has helped the professionals, tax administrators and the judiciary for the last over 80 years in finding solutions to their tax issues. No effort is spared in the present edition to maintain the reputation, which this book has gained in the field of income-tax law for the past eight decades and more.

This locus classics has enjoyed the privilege of patronage from the profession of chartered accountants, tax practitioners, consultants, advisors, advocates, corporate executives, tax administrators and the judiciary.

Volume 1

INTRODUCTION

PRINCIPLES OF CONSTRUCTION

General Principles

Particular Principles-I

Particular Principles-II

(A) Mutuality Principle

(B) Diversion by Overriding Title

(C) Real Income Theory

(D) Concepts of Telescoping and Peak Credit

Chapter I

Preliminary

1. Short title, extent and commencement

2. Definitions

2(1)“Advance tax”

2(1A)“Agricultural income”

2(1B)“Amalgamation”

2(1C)“Additional Commissioner”

2(1D)“Additional Director”

2(2)“Annual value”

2(3)“Appellate Assistant Commissioner” (Omitted)

2(4)“Appellate Tribunal”

2(5)“Approved gratuity fund”

2(6)“Approved superannuation fund”

2(7)“Assessee”

2(7A)“Assessing Officer”

2(8)“Assessment”

2(9)“Assessment year”

2(9A)“Assistant Commissioner”

2(9B)“Assistant Director”

2(10)“Average rate of income-tax”

2(11)“Block of assets”

2(12)“Board”

2(12A)”Books or books of account”

2(13)“Business”

2(13A)“Business trust”

2(14)“Capital asset”

2(15)“Charitable purpose”

2(15A)“Chief Commissioner”

2(15B)“Child”

2(16)“Commissioner”

2(16A)“Commissioner (Appeals)”

2(17)“Company”

2(18)“Company in which the public are substantially interested”

2(19)“Co-operative society”

2(19A)“Deputy Commissioner”

2(19AA)”Demerger”

2(19AAA)”Demerged company”

2(19B)“Deputy Commissioner (Appeals)”

2(19C)”Deputy Director”

2(20)“Director”, “manager” and “managing agent”

2(21)“Director General or Director”

2(22)“Dividend”

2(22A)“Domestic company”

2(22AA)”Document”

2(22AAA)”Electoral Trust”

2(22B)“Fair market value”

2(23)“Firm”, “partner” and “partnership”

2(23A)“Foreign company”

2(23B)“Fringe benefits”

2(23C)“Hearing”

2(24)“Income”

2(25)“Income-tax Officer”

2(25A)“India”

2(26)“Indian company”

2(26A)“Infrastructure capital company”

2(26B)“Infrastructure capital fund”

2(27)“Inspecting Assistant Commissioner” (Omitted)

2(28)“Inspector of Income-tax”

2(28A)“Interest”

2(28B)“Interest on securities”

2(28BB)”Insurer”

2(28C)”Joint Commissioner”

2(28D)”Joint Director”

2(29)“Legal representative”

2(29A)“Liable to tax”

2(29AA)“Long-term capital asset”

2(29B)“Long-term capital gain”

2(29BA)“Manufacture”

2(29C)“Maximum marginal rate”

2(29D)“National Tax Tribunal”

2(30)“Non-resident”

2(31)“Person”

2(32)“Person who has a substantial interest in the company”

2(33)“Prescribed”

2(34)“Previous year”

2(34A)“Principal Chief Commissioner of Income-tax”

2(34B)“Principal Commissioner of Income-tax”

2(34C)“Principal Director of Income-tax”

2(34D)“Principal Director General of Income-tax”

2(35)“Principal officer”

2(36)“Profession”

2(36A)“Public sector company”

2(37)“Public servant”

2(37A)“Rate or rates in force” or “rates in force”

2(38)“Recognised provident fund”

2(39)“Registered firm” (Omitted)

2(40)“Regular assessment”

2(41)“Relative”

2(41A)”Resulting company”

2(42)“Resident”

2(42A)“Short-term capital asset”

2(42B)“Short-term capital gain”

2(42C)”Slump sale”

2(43)“Tax”

2(43A)“Tax credit certificate”

2(43B)“Tax Recovery Commissioner” (Omitted)

2(44)“Tax Recovery Officer”

2(45)“Total income”

2(46)“Total world income” (Omitted)

2(47)“Transfer”

2(47A)“Virtual digital asset”

2(48)“Zero Coupon Bond”

3. “Previous year” defined

SUBJECT INDEX

Details :

- Publisher : Bharat Law House Pvt. Ltd.

- Author : Sampath Iyengar Revised by H. Padamchand Khincha and Chythanya K.K

- Edition : 13th Edition 2024

- ISBN-13 :

- ISBN-10 :

- Language : English

- Binding : Hardcover

| Author | |

|---|---|

| Language | |

| Publisher |

Be the first to review “Bharat’s Law of Income Tax (Volume 1) By Sampath Iyengar – 13th Edition 2024” Cancel reply

Related products

International Taxation

Direct Tax

Commercial’s Direct Taxes Law & Practice (Professional) By Dr Girish Ahuja & Dr Ravi Gupta

Reviews

There are no reviews yet.