-

×

-

×

KP's Women and the Constitution by Nayan Joshi

2 × ₹440.00 -

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

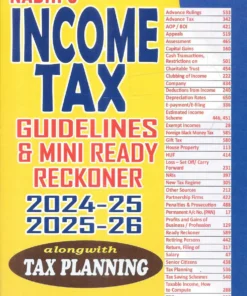

Nabhi’s Income Tax Guidelines & Mini Ready Reckoner 2024-25 & 2025-26

1 × ₹801.00 -

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

-

×

- Publisher : Commercial Law Publishers (India) Pvt. Ltd.

- Author : Ram Dutt Sharma

- Edition : 2nd Edition 2022

- ISBN-13 : 9789356030794

- ISBN-10 : 9789356030794

- Language : English

- Binding : Paperback

KP's Women and the Constitution by Nayan Joshi

KP's Women and the Constitution by Nayan Joshi

Nabhi’s Income Tax Guidelines & Mini Ready Reckoner 2024-25 & 2025-26

Nabhi’s Income Tax Guidelines & Mini Ready Reckoner 2024-25 & 2025-26

Reviews

There are no reviews yet.