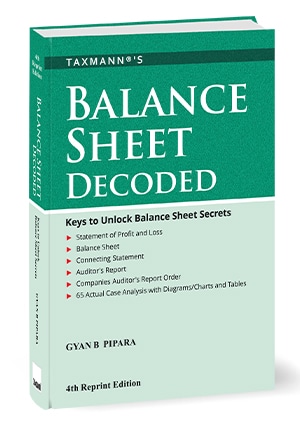

- Paperback : Hardbound

- Publisher : Taxmann

- Author : G.B Pipara

- Edition : 4th Reprint Edition 2024

- Language : English

- ISBN-10 : 9789356221093

- ISBN-13 : 9789356221093

Taxmann’s Balance Sheet Decoded by G.B Pipara

₹1,595.00 Original price was: ₹1,595.00.₹1,196.00Current price is: ₹1,196.00.

Taxmann’s Balance Sheet Decoded (Keys to Unlock Balance Sheet Secrets) by G.B Pipara – 4th Reprint Edition 2024. This book provides a step-by-step guide to reading, analysing, and interlinking financial statements using charts, case analysis, and other tools. It is organised around five key areas—Statement of Profit & Loss, Balance Sheet, Connecting Statements, Auditor’s Report and CARO, and the Master Key, which integrates all components for comprehensive analysis. It is an essential resource for bankers, CFOs, auditors, analysts, investors, and regulators.

9 in stock

Taxmann’s Balance Sheet Decoded (Keys to Unlock Balance Sheet Secrets) by G.B Pipara – 4th Reprint Edition 2024.

Taxmann’s Balance Sheet Decoded (Keys to Unlock Balance Sheet Secrets) by G.B Pipara – 4th Reprint Edition 2024.

Description

This book aims to explain how to read, analyse, and interlink the voluminous information available in financial statements using charts, case analysis, and other tools. It provides an in-depth, step-by-step approach to understanding and decoding financial statements.

The book is structured around five keys, each focusing on different components of financial statements.

- Key #1 – Statement of Profit & Loss

- Covers Sales, Other Income, Cost of Materials Consumed, Manufacturing and Operating Costs, Finance Costs, Depreciation and Amortisation, Tax Expenses, Other Expenses, and Exceptional Items

- Key #2 – Balance Sheet

- Details Tangible and Intangible Fixed Assets, Investments, Loans & Advances, Other Assets, Inventories, Trade Receivables, Cash and Bank Balances, Shareholder’s Funds, Provisions, Contingent Liabilities, Borrowings, Trade Payables, and Other Liabilities

- Key #3 – Connecting Statements

- Examines Significant Accounting Policies, Notes on Accounts, and Cash Flow Statements

- Key #4 – Auditor’s Report and CARO

- Discusses the Concept of Audit, Internal Financial Controls, Auditor’s Opinion, Emphasis of Matters, and the Companies Auditor’s Report Order (CARO)

- Key #5 – Master Key

- Integrates the Profit & Loss Statement, Balance Sheet, Notes on Accounts, Auditor’s Report, and CARO Report for comprehensive financial statement analysis

This book extensively deals with the following issues & suggests how they can be mitigated through proper analysis of financial statements:

- Mounting Bad Loans – Analyses the alarming rise in non-performing assets (NPAs) in Indian public sector banks and the impact of stress tests conducted by the Reserve Bank of India (RBI)

- Bank Frauds – Explores the root causes of bank frauds and provides strategies to mitigate these risks

- Liquidity Crunch – Discusses the liquidity issues faced by various financial sectors and their effects on investment returns

- Regulatory Insights – Guides regulators on using financial statements to ensure compliance and assess financial health

This book will be helpful to anyone analysing based on financial statements, including but not limited to:

- Bankers – Enhance skills in loan appraisal and monitoring through detailed financial statement analysis

- CFOs – Understand the balance between business transactions and necessary disclosures

- Auditors – Identify and counteract accounting tricks to ensure fair financial reporting

- Analysts and Researchers – Conduct thorough financial statement studies to detect misleading practices

- Investors and Stakeholders – Evaluate the genuineness of financial data for informed investment decisions

- Regulators – Use financial information for regulatory assessments and ensure compliance

The Present Publication is the 4th Reprint Edition authored by Gyan B. Pipara, with the following noteworthy features:

- [Reading Between the Lines of Financial Statements] Correlating relevant information using the author’s 40+ years of experience with proper analysis.

- [Honing Analytical Skills] Provides methods to dissect financial statements with precision.

- [Unlocking Mysteries & Tricks] Explains how to analyse details and detect undisclosed information.

- [Focused Analysis] Helps identify strengths, early warning signs, frauds, creative accounting, and the genuineness of various items.

- [Professional Oriented Book] This book has been developed keeping in mind the following factors:

- Interaction of the author during his training with various banks and organisations on credit and analysis of the financial statement

- Shaped by the authors’ experience of 40+ years being a chartered accountant, research analyst and fraud investigator

- Reactions and responses of attendees during the training have also been incorporated at different places in the book

- [New Chapter on CARO 2020] has been considered in detail under Key #4 – The Companies Auditor’s Report Order

The structure of the book is as follows:

- What is it?

- Explains the nature of the item for more accessible analysis

- Do You Know?

- Highlights important legal requirements under the Companies Act, Indian Accounting Standards, or other laws

- Why is it Important?

- Discusses the relevance of the item for financial statement analysis

- How to Analyse to Unlock?

- Provides a step-by-step approach for item analysis

- Case Analysis

- Uses real-life examples to illustrate key points and explain issues

- Bottom Line

- Summarise the key insights of the chapter

The detailed contents of the book are as follows:

- Statement of Profit & Loss

- Revenue from Operations

- This chapter discusses the revenue generated from core business operations, providing insights into how businesses earn from their primary activities. It includes detailed charts that illustrate revenue trends and performance metrics.

- Case studies offer real-world examples of how companies manage and report operational revenues, highlighting best practices and common challenges.

- Other Income

- This chapter covers the income derived from secondary sources such as interest, dividends, and other non-operating income. This section thoroughly analyses various types of other income, how they are generated, and their impact on overall financial performance.

- Charts help visualise the contribution of other income to the total income, while case studies demonstrate the accounting treatment and strategic importance of such income.

- Cost of Materials Consumed and Purchases of Traded Goods

- This chapter focuses on the costs associated with raw materials and traded goods. This section explains the direct costs that impact the cost of goods sold and, consequently, the business’s profitability.

- Charts and diagrams illustrate cost structures and trends, while case studies provide insights into effective cost management strategies.

- Manufacturing and Operating Cost

- This chapter explores the costs involved in the manufacturing process and other operational expenses. Detailed explanations cover labour costs, overheads, and other operational expenditures.

- Charts help understand these costs’ distribution, and case studies show real-life examples of cost optimisation and control measures.

- Finance Cost

- This chapter discusses the cost of financing the operations, including interest expenses on loans and borrowings. This section provides insights into different types of finance costs, their calculation, and their impact on financial health.

- Charts illustrate interest rate trends and financing structures, while case studies highlight the strategic decisions related to financing.

- Depreciation

- This chapter provides a detailed look at depreciation, explaining how assets lose value over time and its impact on financial statements. This section covers various methods of depreciation, their application, and implications for financial reporting.

- Charts show depreciation schedules and case studies illustrate the practical application of different depreciation methods.

- Tax Expense

- This chapter covers the calculation and reporting of tax expenses, which is essential for compliance and financial planning. This section explains different types of taxes, tax liabilities, and their treatment in financial statements.

- Charts and graphs help visualise tax expenses, and case studies provide tax planning and management examples.

- Other Expenses

- This chapter examines miscellaneous expenses not classified elsewhere, offering insights into effectively managing and reporting these costs. This section provides a comprehensive overview of other expenses, their nature, and their impact on financial statements. Charts help categorise these expenses, and practical examples illustrate their management.

- Exceptional Items, Extraordinary Items, and Prior Period Items

- This chapter discusses unusual or non-recurring items that can significantly impact financial results. This section explains the identification, accounting treatment, and disclosure of exceptional, extraordinary, and prior period items.

- Case studies highlight real-life scenarios where these items have been critical in financial reporting.

- Revenue from Operations

- Balance Sheet

- Property, Plant and Equipment – Tangible

- This chapter focuses on tangible fixed assets, their valuation, and depreciation. This section explains how tangible assets are recorded, valued, and depreciated over time. Charts illustrate asset valuation and depreciation schedules, while case studies provide practical asset management and accounting examples.

- Fixed Assets – Intangible

- This chapter covers intangible assets such as patents and trademarks, valuation, and amortisation. This section explains the unique characteristics of intangible assets, how they are accounted for, and their impact on financial statements.

- Case studies illustrate real-world scenarios of managing and valuing intangible assets.

- Investments

- This chapter examines different types of investments, their valuation, and their impact on financial health. This section thoroughly analyses investment types, their accounting treatment, and strategic importance.

- Charts and graphs help visualise investment portfolios, and case studies demonstrate the practical application of investment management principles.

- Loans & Advances

- This chapter discusses loans and advances provided by the company, their accounting treatment, and implications for financial statements. This section covers various types of loans and advances, their terms, and their financial impact.

- Charts illustrate loan structures and repayment schedules, while case studies provide insights into the effective management of loans and advances.

- Other Assets

- This chapter covers other assets not classified under specific headings, explaining their valuation and reporting. This section provides a comprehensive overview of miscellaneous assets, their nature, and impact on financial statements.

- Charts help categorise these assets, and practical examples illustrate their management.

- Inventories and Trade Receivables

- This chapter focuses on inventory management and trade receivables, which are essential for understanding working capital management. This section explains the accounting treatment of inventories and trade receivables, their valuation, and their impact on liquidity.

- Charts and graphs illustrate inventory levels and receivables ageing, while case studies provide practical insights into effectively managing these critical assets.

- Cash, Cash Equivalent, and Bank Balances

- This chapter discusses managing and reporting cash, cash equivalents, and bank balances. This section covers various aspects of cash management, including cash flow, liquidity, and financial stability.

- Charts help visualise cash flow patterns, and case studies demonstrate best practices in cash management.

- Advances Recoverable in Cash or Kind or for Value to be Received

- This chapter covers advances recoverable in cash or kind, explaining their accounting treatment and implications for financial statements. This section provides detailed explanations of different types of advances, their valuation, and recovery processes.

- Case studies illustrate practical examples of managing and reporting advances.

- Shareholders’ Funds or Net Worth or Capital

- This chapter examines the components of shareholders’ equity, including capital stock, retained earnings, and reserves. This section provides insights into the calculation and reporting of net worth, highlighting its importance for financial stability and investor confidence.

- Charts and graphs illustrate changes in equity, while case studies provide real-world examples of managing shareholders’ funds.

- Provisions & Contingent Liabilities

- This chapter discusses recognising, measuring, and reporting provisions and contingent liabilities. This section explains various types of provisions, their accounting treatment, and their impact on financial statements.

- Charts and graphs help visualise provisions and contingencies, while case studies provide practical examples of managing these critical financial elements.

- Borrowings

- This chapter covers different types of borrowings, their terms, and accounting treatment. This section provides a comprehensive overview of debt management, including long-term and short-term borrowings.

- Charts illustrate borrowing structures and repayment schedules, while case studies highlight the strategic decisions related to financing.

- Trade Payable and Other Liabilities

- This chapter examines trade payables and other liabilities, their recognition, and reporting. This section provides insights into the management of payables and liabilities, which are crucial for maintaining financial stability and liquidity.

- Charts and graphs help visualise payables ageing, and practical examples illustrate effective management of trade payables and liabilities.

- Property, Plant and Equipment – Tangible

- Connecting Statement

- Significant Accounting Policies

- This chapter covers companies’ key accounting policies, explaining their impact on financial statements. This section explains various accounting policies, their rationale, and implications for financial reporting.

- Charts help illustrate the application of different policies, and case studies provide practical examples.

- Notes on Accounts

- This chapter discusses the notes to accounts, providing additional information and disclosures related to financial statements. This section explains the importance of notes, their content, and how they enhance the understanding of financial statements.

- Case studies illustrate the practical application of notes and their significance for stakeholders.

- Cash Flow and Statement

- This chapter focuses on the cash flow statement, explaining its preparation and analysis. This section provides detailed explanations of cash flow categories, their importance, and how to interpret cash flow statements.

- Charts and graphs help visualise cash flows, while case studies provide practical examples of cash flow management.

- Significant Accounting Policies

- Concept of Audit and Auditor’s Report and CARO Report

- Understanding the Concept of Audit

- This chapter provides an overview of the audit process, its objectives, and its significance. This section explains the different types of audits, their scope, and how they contribute to financial transparency and accountability.

- Practical examples and case studies illustrate the audit process and its impact on financial reporting.

- Report on Internal Financial Controls

- This chapter discusses the evaluation of internal financial controls, their importance, and reporting. This section provides insights into the internal control framework, its assessment, and implications for financial statements.

- Charts and graphs help visualise internal control structures, and case studies highlight best practices in internal control management.

- Analysis of Auditor’s Opinion

- This chapter examines the auditor’s opinion, types, and significance. This section explains the different types of audit opinions, their implications, and how they affect stakeholder perceptions.

- Charts and graphs illustrate audit opinion trends, while case studies provide practical examples of the impact of different audit opinions.

- Analysis of Emphasis of Matters/Note

- This chapter discusses the emphasis of matters and notes included in audit reports, explaining their importance and implications. This section provides detailed explanations of different types of emphasis and their impact on financial statements.

- Practical examples illustrate the significance of emphasis on matters in audit reports.

- Companies Auditor’s Report Order (CARO)

- This chapter provides an overview of the Companies Auditor’s Report Order (CARO), its requirements, and its significance. This section explains the key provisions of CARO, their implications, and how they enhance the audit process.

- Practical examples illustrate the application of CARO in audit reports.

- Control over Resources

- This chapter examines the control over resources, their importance, and their management. This section provides insights into resource management, internal controls, and their impact on financial performance.

- Charts and graphs help visualise resource management strategies, and case studies provide practical examples of effective resource control.

- Related Party Transactions

- This chapter discusses related party transactions, their identification, and reporting. This section explains the importance of transparency in related party transactions, their accounting treatment, and their impact on financial statements.

- Practical examples illustrate the management and disclosure of related party transactions.

- Legal Compliance

- This chapter covers the importance of legal compliance in financial reporting, explaining key regulatory requirements and their implications. This section provides insights into compliance management, reporting, and its impact on financial statements.

- Practical examples illustrate best practices in legal compliance.

- Non-Banking Finance Companies (NBFC)

- This chapter overviews Non-Banking Finance Companies (NBFC), operations, and regulatory requirements. This section explains the key characteristics of NBFCs, financial reporting, and compliance obligations.

- Practical examples illustrate the management and reporting of NBFCs.

- Statutory Dues

- This chapter discusses the recognition, measurement, and reporting of statutory dues. This section explains various types of statutory dues, their accounting treatment, and their impact on financial statements.

- Charts and graphs help visualise statutory dues, while case studies provide practical examples of managing and reporting statutory obligations.

- Financial Health of the Company

- This chapter examines the indicators of financial health, including profitability, liquidity, and solvency. This section provides insights into analysing financial health, key metrics, and their interpretation.

- Charts and graphs illustrate financial health indicators, while practical examples provide real-world insights into assessing and improving financial health.

- End Use of Funds

- This chapter discusses the importance of monitoring and reporting the end use of funds. This section explains the key aspects of fund utilisation, its impact on financial performance, and compliance requirements.

- Practical examples illustrate best practices in managing and reporting the end use of funds.

- Frauds and Unrecorded Transactions

- This chapter covers identifying, preventing, and reporting fraud and unrecorded transactions. This section provides insights into fraud risk management, detection techniques, and their impact on financial statements.

- Charts and graphs help visualise fraud risk, while case studies provide practical examples of managing and reporting fraud.

- Resignation of Statutory Auditors

- This chapter discusses the reasons, implications, and reporting of the resignation of statutory auditors. This section explains the impact of auditor resignation on financial reporting, stakeholder confidence, and regulatory compliance.

- Practical examples illustrate the management and disclosure of auditor resignation.

- Understanding the Concept of Audit

- Master Key

- How to Link 5 Keys to Decode Financial Statement

- This chapter provides a comprehensive guide on linking the key concepts discussed in the book to decode and analyse financial statements. This section explains the interrelationships between financial statement components, their analysis, and interpretation.

- Charts and graphs help visualise these connections, while practical examples provide step-by-step guidance on financial statement analysis.

- How to Link 5 Keys to Decode Financial Statement

Details

| Publisher | |

|---|---|

| Author | |

| Language |

Be the first to review “Taxmann’s Balance Sheet Decoded by G.B Pipara” Cancel reply

Related products

GST

Bharat’s How to handle GST Audit with real life case studies by CA. Arun Chhajer – 1st Edition 2023

Direct Tax

Commercial’s Direct Taxes Law & Practice (Professional) By Dr Girish Ahuja & Dr Ravi Gupta

MSME

Bloomsbury’s Treatise on Micro, Small and Medium Enterprises by Rajeev Babel – 1st Edition June 2021

Reviews

There are no reviews yet.