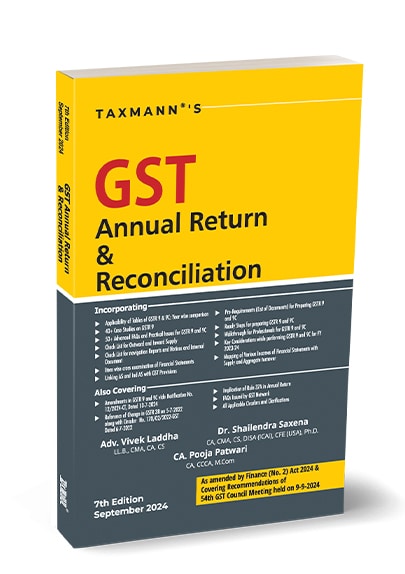

- Binding : Softcover

- Publisher : Taxmann

- Author : Vivek Laddha, Pooja Patwari & Shailendra Saxena

- Edition : 7th Edition September 2024

- Language : English

- ISBN-10 : 9789364559348

- ISBN-13 : 9789364559348

Taxmann’s GST Annual Return & Reconciliation by Vivek Laddha – 7th Edition 2024

₹995.00 Original price was: ₹995.00.₹746.00Current price is: ₹746.00.

Taxmann’s GST Annual Return & Reconciliation by Vivek Laddha – 7th Edition September 2024. This book provides a detailed clause-by-clause analysis of GSTR-9, GSTR-9A, and GSTR-9C, along with practical filing steps for accurate compliance. It features over 40 case studies and 50+ advanced FAQs to address common challenges, as well as comprehensive checklists for outward and inward supplies. The book is updated with the latest amendments and provides tools like a quick reference locator, legal clarifications, and detailed guides for managing multi-year data in GST returns.

10 in stock

Taxmann’s GST Annual Return & Reconciliation by Vivek Laddha – 7th Edition September 2024.

Taxmann’s GST Annual Return & Reconciliation by Vivek Laddha – 7th Edition September 2024.

Incorporating:

The book is a comprehensive guide focused on simplifying the filing and reconciliation process of GSTR-9, GSTR-9A, and GSTR-9C for registered taxpayers and professionals. It provides a clause-by-clause analysis of these forms, offers practical steps for accurate filing, and includes more than 40 case studies and 50+ advanced FAQs to address common and complex issues.

The book also incorporates the latest amendments, updates, and official clarifications to ensure compliance with GST regulations. Additionally, it features checklists for compliance on outward and inward supplies, providing a complete toolset for those involved in preparing and filing GST annual returns and reconciliations.

This book is helpful for GST practitioners, tax consultants, businesses, registered taxpayers, chartered accountants, and legal professionals involved in GST return preparation, reconciliation, and compliance.

The Present Publication is the 7th Edition, amended by the Finance (No. 2) Act 2024. It also covers the recommendations of the 54th GST Council Meeting and is authored by Adv. Vivek Laddha, Dr Shailendra Saxena & CA. Pooja Patwari, with the following noteworthy features:

- [Clause-by-Clause Analysis] The book breaks down the complexities of Forms GSTR-9, GSTR-9A, and GSTR-9C, providing a detailed clause-by-clause explanation. This enables users to understand the nuances of each form, ensuring error-free filing

- [Practical Filing Steps] The inclusion of ready steps for filing GSTR-9 and GSTR-9C equips professionals with actionable insights into the preparation process

- [Case Studies and FAQs] More than 40 real-world case studies on GSTR-9 provide practical scenarios that readers can relate to, helping them understand potential challenges. Additionally, 50+ advanced FAQs address complex queries related to annual return

- [Comprehensive Checklists] The book provides a detailed compliance checklist covering outward and inward supplies. This checklist serves as a quick reference for registered persons, professionals, and technical experts, ensuring all necessary checks are performed before filing

- [Updated with Latest Amendments] Reflecting the latest changes in GST laws, the book incorporates amendments made by Notification No. 12/2024-CT, dated 10-07-2024, and updates relating to GSTR-3B, Rule-37A, and other regulatory developments. References to Press Releases and official clarifications ensure that readers are up-to-date with the latest procedural requirements, clarifying areas of ambiguity in GST return filing.

- [Practical Tools]

- Locator for Quick Reference – A special feature of this book is its topic locator, which enables readers to quickly reference key elements of GSTR-9, GSTR-9A, and GSTR-9C preparation, saving time and ensuring accuracy

- Case Studies on Outward and Inward Supplies – Separate chapters dedicated to case studies on outward and inward supplies help readers understand how to manage data when preparing annual returns for FY 2022-23 and its declaration in the returns of FY 2023-24

- Bare Laws, Forms, and Clarifications – The book includes the text of relevant laws, formats of forms, and clarifications issued by the GST Network and other regulatory bodies, ensuring professionals have access to all the legal resources required for compliance

The book covers a wide array of topics critical for understanding and complying with the GST annual return and reconciliation process, including:

- Legal Consequences of Wrong Filing

- The book discusses the potential legal repercussions of incorrect or delayed filings, providing insights into mitigating these risks

- Annual Accounts vs. Annual Return vs Reconciliation Statement

- A clear comparison between these important components helps professionals understand how to reconcile financial data with GST returns

- Turnover in the GST Regime

- Special attention is given to the concept of turnover, a critical factor in determining the applicability of GSTR-9 and GSTR-9C

- Impact of Data from Previous and Current Financial Years

- The book exhaustively covers the impact of data from FY 2022-23 declared in the return for FY 2023-24 and the impact of FY 2023-24 declared in FY 2024-25. This detailed analysis assists professionals in managing adjustments and reconciling multi-year data effectively

- Advanced Topics

- New chapters address key considerations for preparing the annual return and reconciliation for FY 2023-24, including an updated locator that helps users navigate the book efficiently

Details

| Publisher | |

|---|---|

| Language | |

| Author |

Be the first to review “Taxmann’s GST Annual Return & Reconciliation by Vivek Laddha – 7th Edition 2024” Cancel reply

Related products

GST

Bharat’s How to handle GST Audit with real life case studies by CA. Arun Chhajer – 1st Edition 2023

International Taxation

Direct Tax

Taxmann’s Digital Taxation – A Holistic View by Rashmin Chandulal Sanghvi 1st Edition December 2019

MSME

Bloomsbury’s Treatise on Micro, Small and Medium Enterprises by Rajeev Babel – 1st Edition June 2021

Reviews

There are no reviews yet.