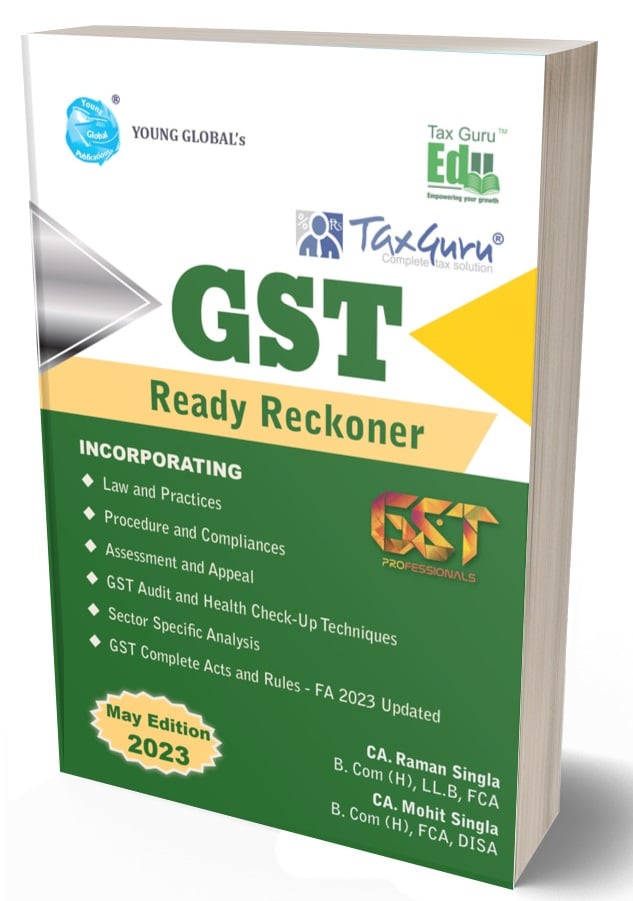

Young Global’s GST Ready Reckoner by Raman Singla – Edition May 2023

₹2,495.00 Original price was: ₹2,495.00.₹1,871.00Current price is: ₹1,871.00.

Young Global’s GST Ready Reckoner by Raman Singla – Edition May 2023.

7 in stock

Young Global’s GST Ready Reckoner by Raman Singla – Edition May 2023.

Young Global’s GST Ready Reckoner by Raman Singla – Edition May 2023.

Key Features :

GST law is technology driven, highly comprehensive, multi- stage, destination- based tax system and is levied on every value addition. The GST implementation brings numerous advantages to India, however, it brings along certain challenges related to understanding and implementation. The time demands for more responsive, crisp and solution-oriented approach in our work domains.

We are pleased to introduce a short, crisp and problem-solving addition of our GST Book titled ‘GST Ready Reckoner’. This new version would not only facilitate the apparent needs but also addresses the inherent challenges and complexity of this law in the most simplified manner for its users.

This GST Ready Reckoner is a masterpiece written by CA Raman Singla to simplify the most complex tax structure of the world to assist GST Professionals, Businessmen, Tax Payers and Other Stakeholders connected and impacted with GST Law enabling them to maintain a compliant and hassle- free tax structure. Considering the need to address the notices of GST department connected to audit and assessment matters, we have covered in detail, the most sought-after topic ‘GST Audit and Health Check-Up Techniques’ as a bonus to the readers.

The GST Ready Reckoner is unique with its design, depth and delivery and works as a self- help book on the subject. It is written in a language which is simple, understandable and addresses complex issues of the law with great ease and comfort. The systematic analysis of bare provisions of the law would not only meet the requirement of GST Professionals but would give them deeper understanding and clarity on the subject.

The present edition of the book is thoroughly revised and has incorporated many new features to provide its readers a comprehensive analysis of laws, amendments, notifications, circulars, press releases, case laws and related FAQ’s to facilitate complete grip over the subject. In order to enhance the user reading experience, the “GST Ready Reckoner” is divided into six parts and runs into 1200+ pages.

Part 1 – Law and Practices

Part 2 – Procedure and Compliances

Part 3 – Assessments and Appeal

Part 4 – GST Audit and Health Check-Up Techniques

Part 5 – Sector Specific Analysis

Part 6 – GST Complete Acts and Rules (Updated up to date).

Details :

- Publisher : Young Global

- Author : Raman Singla

- Edition : May 2023

- ISBN-13 : 9788188274796

- ISBN-10 : 9788188274796

- Binding : Paperback

- Language : English

| Publisher | |

|---|---|

| Author | |

| Language |

Reviews

There are no reviews yet.