-

×

2 × ₹276.00

2 × ₹276.00 -

×

KP's Women and the Constitution by Nayan Joshi

1 × ₹440.00

KP's Women and the Constitution by Nayan Joshi

1 × ₹440.00 -

×

1 × ₹1,996.00

1 × ₹1,996.00 -

×

1 × ₹2,498.00

1 × ₹2,498.00 -

×

1 × ₹647.00

1 × ₹647.00 -

×

1 × ₹695.00

1 × ₹695.00 -

×

1 × ₹864.00

1 × ₹864.00 -

×

1 × ₹1,349.00

1 × ₹1,349.00 -

×

1 × ₹1,951.00

1 × ₹1,951.00 -

×

1 × ₹1,913.00

1 × ₹1,913.00

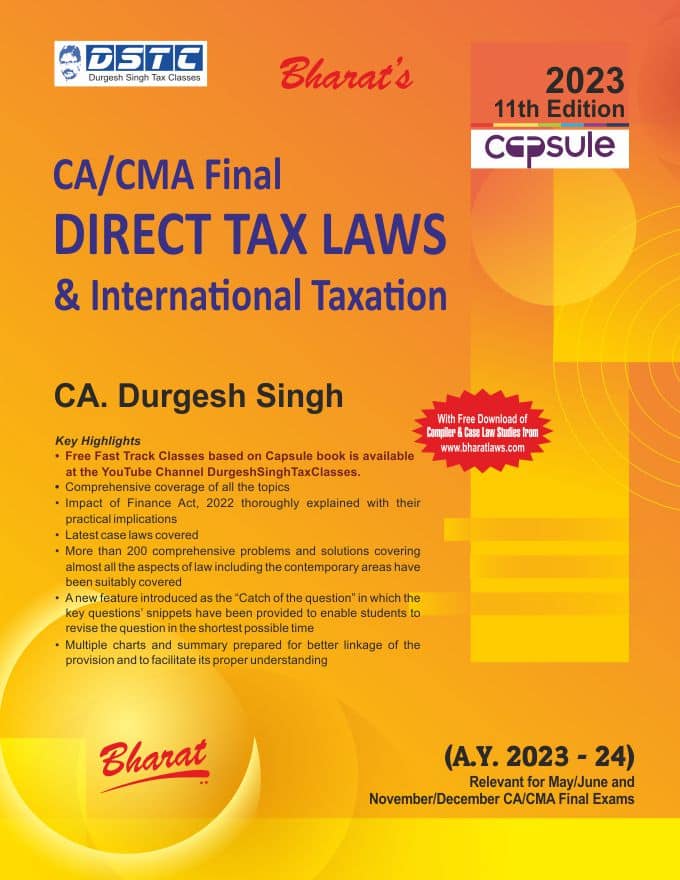

Bharat’s Capsule Studies on Direct Tax Laws & International Taxation (A.Y. 2023-24) by Durgesh Singh for May 2023 Exam

₹1,750.00 Original price was: ₹1,750.00.₹1,453.00Current price is: ₹1,453.00.

Bharat’s Capsule Studies on Direct Tax Laws & International Taxation (A.Y. 2023-24) for CA (Final) (New Syllabus) by CA. Durgesh Singh for May/Nov 2023 Exam – 11th Edition 2023.

8 in stock

SKU: Bharat's Capsule Studies on Direct Tax Laws & International Taxation (A.Y. 2023-24) by Durgesh Singh for May 2023 Exam

Categories: CA Final, Direct Tax Laws & International Taxation, Professional Exams

Tag: Direct Taxes

Bharat’s Capsule Studies on Direct Tax Laws & International Taxation (A.Y. 2023-24) for CA (Final) (New Syllabus) by CA. Durgesh Singh for May/Nov 2023 Exam – 11th Edition 2023.

Bharat’s Capsule Studies on Direct Tax Laws & International Taxation (A.Y. 2023-24) for CA (Final) (New Syllabus) by CA. Durgesh Singh for May/Nov 2023 Exam – 11th Edition 2023.

Description

Preface

Why Grow Old?

Detailed contents

Taxation of Unit Linked Insurance Plan – FA 2021

1 Income Tax Rates

2 Income from Salaries

3 Income from House Properties

4 Profits and Gains from Business Or Profession

5 Business Deductions under Chapter VIA & 10AA

6 Income Computation and Disclosure Standards (ICDS)

7 Alternate Minimum Tax

8 Assessment of Partnership Firms

9 Chapter VI-A Deductions

10 Capital Gains

11 Income from Other Sources

12 Set Off and Carry Forward of Losses

13 Clubbing Provisions

14 Assessment Procedure

15 Rectification, Appeal & Revision

16 Recovery Proceedings

17 Authority of Advance Ruling and Dispute Resolution

18 Penalties and Prosecution

19 Refund Provisions

20 Special Tax Rates for Companies

21 Alternative Tax Regime

22 Co-operative Society and Producer Companies

23 Taxation of Dividend

24 Surrogate Taxation

25 Trust Taxation

26 Hindu Undivided Family

27 Association of Person (AOP) & Body of Individual (BOI)

28 Liabilities In Special Cases

29 Tax Deducted at Source

30 Tax Collected at Source

31 Advance Tax & Interest

32 Non Resident Taxation

33 Taxation of NR Sportsman

34 Double Taxation Relief

35 Miscellaneous Provisions

36 Equalization Levy

37 Transfer Pricing

38 Non Resident Taxation for Capital Gain

39 Miscellaneous Provisions of International Taxation

40 General Anti-Avoidance Rules (GAAR)

41 Appendices

Details :

- Publisher : Bharat Law House Pvt. Ltd.

- Author : CA. Durgesh Singh

- Edition : 11th Edition 2023

- ISBN-13 : 9789393749543

- ISBN-10 : 9789393749543

- Language : English

- Binding : Paperback

| Publisher | |

|---|---|

| Language | |

| Author |

Be the first to review “Bharat’s Capsule Studies on Direct Tax Laws & International Taxation (A.Y. 2023-24) by Durgesh Singh for May 2023 Exam” Cancel reply

Related products

15% Off

15% Off

Direct Tax Laws & International Taxation

Snow white’s Direct Tax Laws & International Taxation by T. N. Manoharan for Nov 2024

25% Off

25% Off

Direct Tax

Bharat’s Direct Taxes Manual (3 Volumes) as Amended by The Finance Act, 2024 – 32nd Edition 2024

25% Off

25% Off

25% Off

15% Off

Reviews

There are no reviews yet.