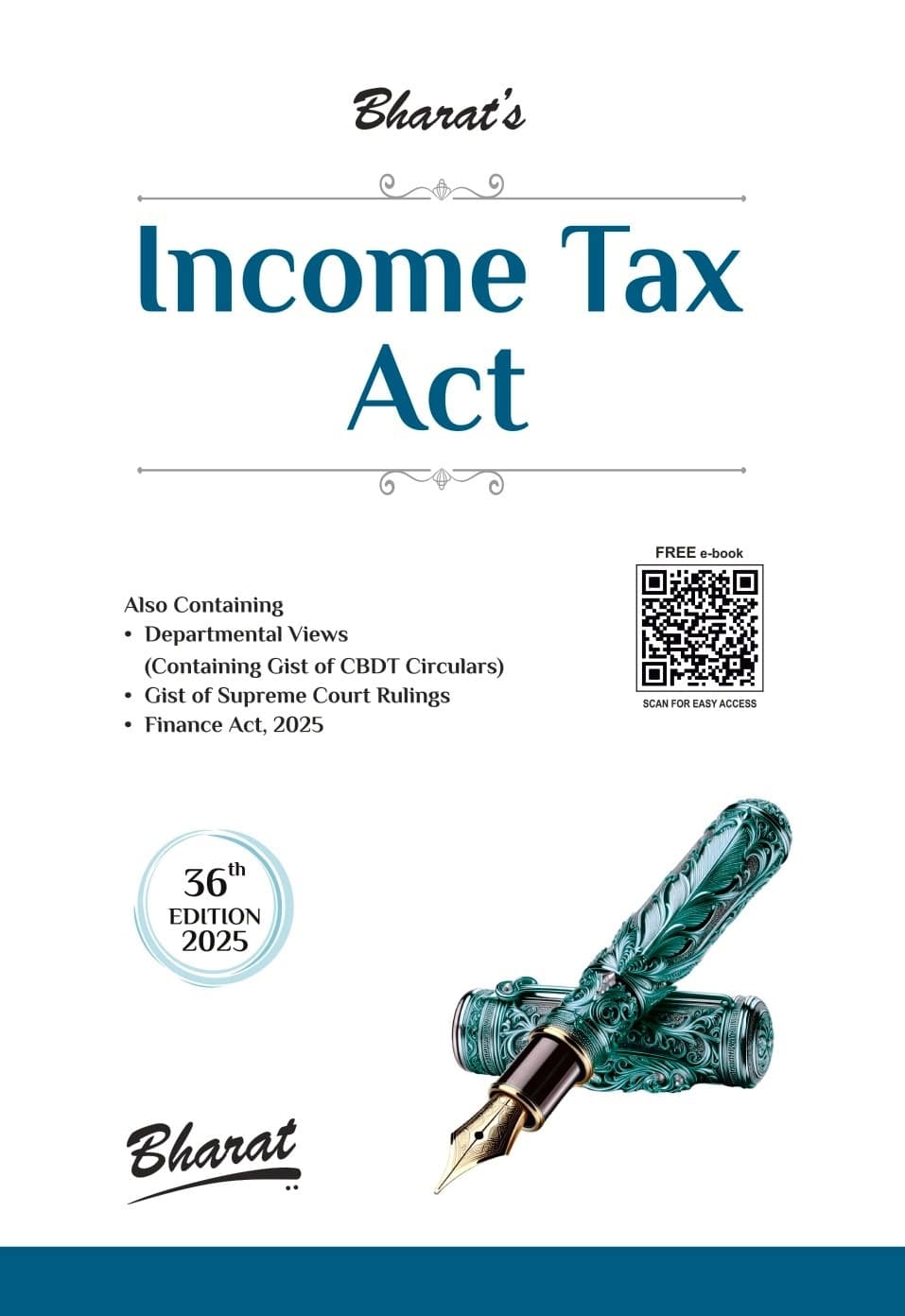

Bharat’s Income Tax Act with Departmental Views – 36th Edition 2025

₹2,695.00 Original price was: ₹2,695.00.₹2,021.00Current price is: ₹2,021.00.

Bharat’s Income Tax Act with Departmental Views – 36th Edition 2025.

100 in stock

Bharat’s Income Tax Act with Departmental Views – 36th Edition 2025.

Bharat’s Income Tax Act with Departmental Views – 36th Edition 2025.

About Income Tax Act with Departmental Views

1.Income-tax Act, 1961

Text of sections

Chronological list of Amendment Acts

SUBJECT INDEX

Appendix 1: Important Circulars and Notifications

Appendix 2: The Finance Act, 2025

Income Tax

Central Goods and Services Tax

THE FIRST SCHEDULE: Rates of Taxes

PART I: Income Tax

PART II: Rates for Deduction of Tax at Source in Certain Cases

PART III: Rates for Charging Income-Tax in Certain Cases, Deducting Income-Tax from Income Chargeable under the Head “Salaries” and Computing “Advance Tax”

PART IV: Rules for Computation of Net Agricultural Income

2.Securities Transaction Tax

3. Commodities Transaction Tax

Details :

- Publisher : Bharat Law House Pvt. Ltd.

- Author : Bharat

- Edition : 36th Edition 2025

- ISBN-13 : 9788119565771

- ISBN-10 : 9788119565771

- Pages : 1656 pages

- Language : English

- Binding : Paperback

| Publisher | |

|---|---|

| Language | |

| Author |

Reviews

There are no reviews yet.