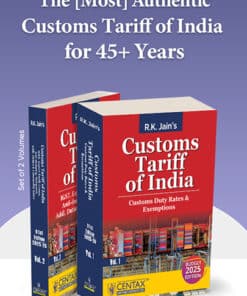

- Publisher : Centax Publication

- Author : R.K. Jain

- Edition : 74th Edition 2025-26

- Language : English

- ISBN-10 : 9789349247352

- ISBN-13 : 9789349247352

Centax’s Customs Law Manual 2025-26 by R.K. Jain – 74th Edition 2025-26

₹3,995.00 Original price was: ₹3,995.00.₹3,316.00Current price is: ₹3,316.00.

Centax’s Customs Law Manual 2025-26 (Set of 2 Volume) by R.K. Jain – 74th Edition 2025-26. R.K. Jain’s Customs Law Manual is a meticulously updated two-volume reference, reflecting the latest changes introduced by the Finance Act 2025. It spans procedures, forms, notifications, and allied regulations, consolidating expertise dating back to 1986 for seamless compliance and in-depth analysis. Tailored to customs professionals, corporate compliance teams, government officers, and academics, it provides clear guidance on all facets of customs law. Volume 1 details the Customs Act, rules, and appellate provisions, while Volume 2 delves into practical forms, SEZ guidelines, and a chronological registry of notifications. Its structured layout, cross-references, and exhaustive indexing ensure effortless navigation and practical applicability.

10 available for pre-ordering

Centax’s Customs Law Manual 2025-26 (Set of 2 Volume) by R.K. Jain – 74th Edition 2025-26.

Centax’s Customs Law Manual 2025-26 (Set of 2 Volume) by R.K. Jain – 74th Edition 2025-26.

CONTENTS:

R.K. Jain’s Customs Law Manual is a comprehensive, up-to-date reference covering Indian Customs laws, procedures, rules, regulations, allied acts, and the latest amendments introduced by the Finance Act 2025. This two-volume set delivers detailed analysis, official forms, relevant notifications, and critical commentary. The manual consolidates decades of legislative developments and practical insights, with historical editions dating back to 1986. Each revision ensures practitioners remain informed about changes in customs regulations, new compliance requirements, and procedural updates mandated by the Central Board of Indirect Taxes and Customs (CBIC).

This book is intended for the following audience:

- Customs Practitioners and Tax Consultants – Lawyers, chartered accountants, and consultants dealing with customs, excise, or indirect taxation will find this manual essential for day-to-day reference and expert analyses

- Corporate Legal & Compliance Teams – Companies involved in import/export operations, supply chain management, freight forwarding, and logistics need reliable information to ensure compliant procedures and documentation

- Government Officials & Academicians – Customs officers, departmental adjudicators, and students or researchers in law or commerce seeking a thorough understanding of the Indian customs framework

- Importers & Exporters – Business owners, Customs House Agents (CHAs), and exporters/importers looking for clear guidelines on procedures and documentation for hassle-free compliance

The Present Publication is the 74th Edition | 2025-26, amended by the Finance Act 2025. This book is edited by Centax’s Editorial Board with the following noteworthy features:

- [Finance Act 2025 Amendments] Incorporates all changes brought by the latest Finance Act, ensuring readers have the most current legal references

- [Two-volume Set] Split logically for ease of reference, with Volume 1 focusing on the Customs Act, Rules, and primary notifications, and Volume 2 covering forms, bonds, allied legislation, CBIC’s Customs Manual, Special Economic Zones (SEZ), and chronological notifications

- [Forms & Bonds] Presents Customs forms, bonds, and applications (from import declarations to appeals) with step-by-step guidance on their usage

- [Allied Acts & Regulations] Includes relevant statutes such as the Foreign Trade (Development & Regulation) Act, Provisional Collection of Taxes Act 2023, COFEPOSA, Foreign Exchange Management Act, etc.

- [CBIC’s Latest Instructions & Circulars] Offers updated commentary and instructions for practical compliance, from warehousing procedures to dispute resolution

- [Special Economic Zones] Dedicated coverage of SEZ laws, rules, and procedures essential for businesses operating in SEZs

- [Extensive Table of Contents & Indexing] Streamlined structure for quick reference, with subheadings reflecting real-world customs scenarios

The volume-wise coverage of the book is as follows:

- Volume 1

- Introduction to Customs Law – Historical context and evolution

- Customs Act 1962 – Full text with detailed annotations

- Rules & Regulations – Including Valuation Rules, Baggage Rules, Drawback Rules, Handling of Cargo in Customs Areas Regulations, etc.

- Appeals & Revisions – Procedures for appeals before the Commissioner (Appeals) and tribunals, including the Customs, Excise & Service Tax Appellate Tribunal (CESTAT)

- Notifications – Exhaustive reference to notifications under the Customs Act, arranged thematically

- Volume 2

- Customs Forms & Bonds – Forms with sample formats and instructions covering import declarations, warehousing bonds, shipping bills, transhipment permits, etc.

- Allied Acts, Rules & Regulations – Key statutes affecting customs operations, including foreign trade policies and allied taxes

- CBIC’s Customs Manual & Instructions – A consolidated manual detailing step-by-step procedures, classification, valuation, warehousing, transhipment, authorised economic operators (AEO), etc.

- Special Economic Zones – Full text of SEZ Act, 2005, SEZ Rules, 2006, plus procedures and forms related to SEZ operations

- Chronological List of Notifications – A curated list of notifications issued under the Customs Act, 1962, by the Finance Ministry and Commissionerates, displayed in chronological order for reference

The structure of the book is as follows:

- Logical Segmentation – Each part (or chapter) addresses a major component of Customs law—beginning with the core Act, followed by rules, and culminating in forms, notifications, and special focus areas like SEZ

- User-friendly Navigation – Chapters begin with concise introductions, while cross-references help link related topics (e.g., from the Customs Act to the relevant forms or CBIC circulars)

- Flow of Information – Progresses from fundamental legal provisions in Volume 1 to practical tools, forms, and specialised regulations in Volume 2, reflecting the actual process flow in day-to-day customs work.

About the author

Sh. R.K. Jain is a distinguished author specialising in Indirect Taxes, including Customs, Central Excise, Service Tax, Foreign Trade Policy (FTP), GST, and FEMA. He began his illustrious career in the early seventies. In 1975, he published the seminal works ‘Customs & Excise Tariffs and Manuals,’ which have recently celebrated their Silver and Golden Jubilee Editions.

Sh. R.K. Jain is also the editor of ‘Excise Law Times (E.L.T.),’ launched nearly 45 years ago. This journal brought significant awareness to Central Excise and Customs and has grown to become the leading publication in its field with the largest circulation.

In addition to E.L.T., he started ‘Service Tax Review’ in 2006 and ‘R.K. Jain’s GST Law Times’ in 2017, following the major Indirect Tax Reform introduced by GST. ExCus, the digital version of these journals, continues to provide valuable insights and updates on Indirect Taxes.

Details

| Publisher | |

|---|---|

| Author | |

| Language |

Be the first to review “Centax’s Customs Law Manual 2025-26 by R.K. Jain – 74th Edition 2025-26” Cancel reply

Related products

MSME

Bloomsbury’s Treatise on Micro, Small and Medium Enterprises by Rajeev Babel – 1st Edition June 2021

Income Tax

Commercial’s Filing of Indian Income Tax Updated Return by Ram Dutt Sharma – Edition 2023

Reviews

There are no reviews yet.