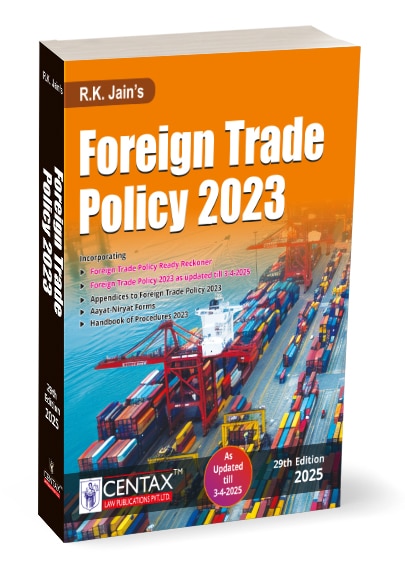

- Publisher : Centax Publication

- Author : R.K Jain

- Edition : 29th Edition April 2025

- Language : English

- ISBN-10 : 9789391055721

- ISBN-13 : 9789391055721

Centax’s Foreign Trade Policy 2023 by R.K Jain – 29th Edition April 2025

₹2,595.00 Original price was: ₹2,595.00.₹2,206.00Current price is: ₹2,206.00.

Centax’s Foreign Trade Policy 2023 by R.K Jain – 29th Edition April 2025. R.K. Jain’s Foreign Trade Policy 2023, updated till 3rd April 2025, offers a comprehensive overview of India’s evolving trade regulations, best practices, and policy frameworks. It is a trusted reference for exporters, importers, legal professionals, students, and policymakers, featuring a Ready Reckoner, step-by-step guidance, and handy flowcharts. The key highlights include e-commerce exports, SCOMET licensing, and an amnesty scheme for export obligations, with additional MSME benefits. Edited by the Centax’s Editorial Board, this Edition also consolidates crucial notifications, forms, and appendices, making it an indispensable guide to India’s trade landscape.

10 in stock

Centax’s Foreign Trade Policy 2023 by R.K Jain – 29th Edition April 2025.

Centax’s Foreign Trade Policy 2023 by R.K Jain – 29th Edition April 2025.

CONTENTS:-

R.K. Jain’s Foreign Trade Policy 2023 is a comprehensive reference work that provides an in-depth view of India’s foreign trade regulations, policy frameworks, and procedures. It is a trusted reference for understanding the evolving paradigms of foreign trade, reflecting the government’s ongoing initiatives, amendments, and best practices in international trade. This Edition integrates recent policy changes, highlights administrative simplifications, and offers a Ready Reckoner for quick reference.

This book is intended for the following audience:

- Exporters and Importers – Whether established or aspiring, businesses engaged in cross-border trade will find clarity on regulations, licensing, and compliance requirements

- Legal and Compliance Professionals – Advocates, consultants, and in-house counsel can rely on the text for authoritative references to legislation, procedures, and official guidelines

- Students and Academics – Ideal for universities and research institutions offering courses in international business, commerce, or law, providing structured insights into India’s foreign trade policies

- Policy Makers and Government Officials – A valuable resource for understanding recent reforms, policy rationales, and administrative mechanisms

The Present Publication is the 29th Edition | 2025, updated till 3rd April 2025. This book is edited by Centax’s Editorial Board with the following noteworthy features:

- [Foreign Trade Policy Ready Reckoner] A concise, user-friendly tool that summarises critical provisions, eligibility criteria, and compliance steps for a quick grasp of policy essentials

- [Up-to-Date Legislation & Notifications] Incorporates all major changes and updates introduced up to 3rd April 2025, including the latest notifications, circulars, and allied rules that shape India’s export-import landscape

- [Handbook of Procedures 2023] Offers step-by-step guidance on procedure, documentation, and policy compliance, supplemented by practical examples and flowcharts

- [Appendices & Aayat-Niryat Forms] Comprehensive collection of relevant forms and appendices, tailored to facilitate smooth application, licensing, and authorisation processes

- [Coverage of E-Commerce Exports & Emerging Sectors] Reflects recent policy thrusts on facilitating e-commerce exports, merchant trade, and green technology exports

- [Amnesty Scheme & SCOMET Licensing] Detailed analysis of the special one-time amnesty scheme for default in export obligations, along with a streamlined overview of SCOMET guidelines

- [Extensive Cross-references & Glossaries] Includes a clear glossary of acronyms and cross-references for easy navigation and deeper understanding

- [Historical Perspective] Traces the Edition of India’s Foreign Trade Policy from the 1st Edition (2000) to the 29th Edition (2025), reflecting the country’s journey through various economic phases

- [Relevance to MSMEs] Highlights concessions and reduced fees for MSMEs, making the policy more inclusive and encouraging small-scale exporters to engage in international trade

The coverage of the book is as follows:

- Foreign Trade Policy 2023

- Comprehensive text of the policy outlining principles, objectives, and the Government’s approach to boosting India’s exports through simplification, incentivisation, and international collaboration

- Ready Reckoner

- Summaries and quick reference guides that encapsulate complex regulations into digestible checklists and bullet points

- Handbook of Procedures 2023

- Detailed procedural guidelines for obtaining and fulfilling Export Promotion Capital Goods (EPCG) authorisations, Advance Authorisations, and other schemes

- Appendices

- Exhaustive coverage of all reference materials—mandatory notifications, advisory circulars, classification lists, and format templates essential for foreign trade transactions

- Aayat-Niryat (ANF) Forms

- A full suite of frequently used forms required to navigate the export-import ecosystem, supplemented by instructions and samples for error-free submission

- Notifications & Allied Act & Rules

- Important statutory instruments that shape the operational landscape of exports and imports—compiled systematically for quick reference

The structure of the book is as follows:

- Abstract of Contents – A snapshot of key portions (Glossary, Key Highlights)

- Part 1 | Foreign Trade Policy Ready Reckoner – Fast-paced overview; highlights major themes, shifts, and compliance pointers

- Part 2 | Foreign Trade Policy 2023 – Full text of the policy, with explanatory notes and practical illustrations

- Part 3 | Handbook of Procedures 2023 – Step-wise elaboration of procedures, documentation pathways, and compliance frameworks

- Part 4 | Appendices to Handbook of Procedures – Additional clarifications and reference documents for specialised or sector-specific requirements

- Part 5 | Aayat-Niryat Forms – Collection of mandatory application forms for licenses, registrations, and allied processes

- Part 6 | Notifications – Compilation of all relevant government notifications that update or modify trade policies

- Part 7 | Allied Act & Rules – Selected statutes and rules essential for complete regulatory compliance

- List of Notifications – Quick reference index to notifications discussed or included in the publication

Centax’s Editorial Board

The CENTAX Editorial Board constitutes a distinguished consortium of tax professionals, former revenue officials, legal practitioners, and academic scholars dedicated to systematically examining and exposing India’s indirect tax and foreign‑trade jurisprudence. The Team functions under the stewardship of Shri R. K. Jain, a venerated author whose treatises on Customs, Central Excise, Service Tax, the Goods and Services Tax (GST), the Foreign Trade Policy (FTP), and the Foreign Exchange Management Act (FEMA) have long been recognised as industry benchmarks.

Shri R.K. Jain commenced his scholarly contribution to the field of indirect taxation in the early 1970s and, in 1975, inaugurated the seminal work Customs & Excise Tariffs and Manuals, editions of which have since commemorated both Silver‑ and Golden‑Jubilee milestones. In 1980, he founded Excise Law Times (ELT), now India’s most widely circulated journal on Central Excise and Customs law, acclaimed for its authoritative reporting of statutory amendments and judicial precedents. His subsequent initiatives—Service Tax Review (2006) and GST Law Times (2017)—have continued this legacy in line with successive legislative reforms, while the digital platform EXCUS ensures real‑time, nationwide dissemination of the Team’s analyses.

Through rigorous statutory commentary, exhaustive digests of case law, and meticulously curated procedural guides, the CENTAX Editorial Team provides indispensable reference material for the Bench, the Bar, corporate tax departments, compliance officers, policymakers, and scholars of fiscal law. Guided by Shri R.K. Jain’s founding conviction that ‘law should be precise, accessible, and practicable,’ the Team remains committed to presenting complex legislative developments with the clarity, exactitude, and doctrinal rigour demanded by the legal fraternity and the wider trade community.

Details

| Author | |

|---|---|

| Language | |

| Publisher |

Be the first to review “Centax’s Foreign Trade Policy 2023 by R.K Jain – 29th Edition April 2025” Cancel reply

Related products

Transfer Pricing

Bharat's Law of Income Tax (Volume 5) By Sampath Iyengar - 13th Edition 2024

Bharat's Law of Income Tax (Volume 5) By Sampath Iyengar - 13th Edition 2024

Reviews

There are no reviews yet.