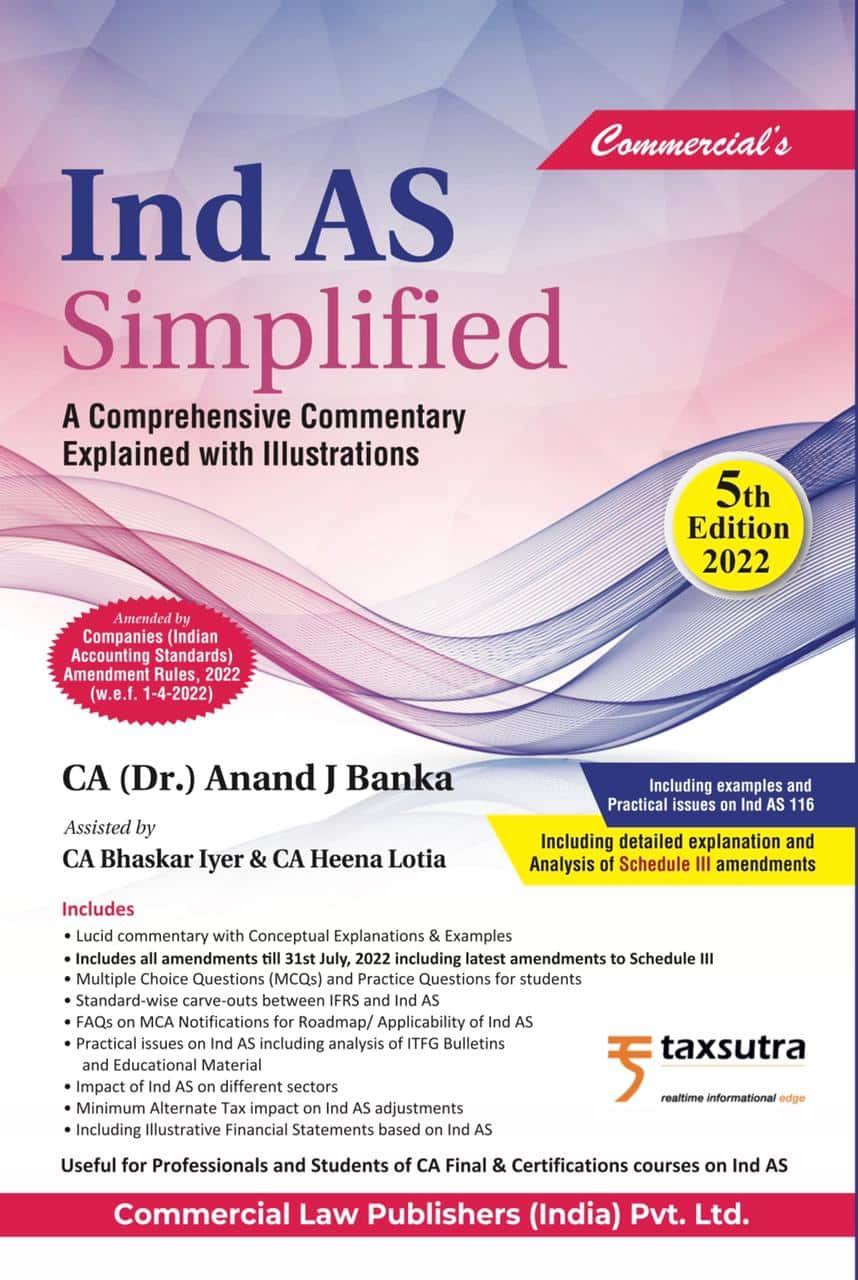

Commercial’s Ind AS Simplified – A Comprehensive Commentary Explained with Illustrations By Anand J. Banka – 5th Edition 2022

₹3,295.00 Original price was: ₹3,295.00.₹2,471.00Current price is: ₹2,471.00.

Commercial’s Ind AS Simplified – A Comprehensive Commentary Explained with Illustrations (Amended by IND As amendment Rules dated 31-07-2022) By Anand J. Banka – 5th Edition 2022.

7 in stock

Commercial’s Ind AS Simplified – A Comprehensive Commentary Explained with Illustrations (Amended by IND As amendment Rules dated 31-07-2022) By Anand J. Banka – 5th Edition 2022.

Commercial’s Ind AS Simplified – A Comprehensive Commentary Explained with Illustrations (Amended by IND As amendment Rules dated 31-07-2022) By Anand J. Banka – 5th Edition 2022.

Key Features :

This book is an attempt to make the understanding of the Ind AS simple through lucid explanations and illustrations for each concept. The book contains industry-wise impact study, easy and quick referencer of standards, standard-wise list of exemptions and exceptions, comparison with Accounting Standards (AS) and Income Computation and Disclosure Standards (ICDS), and many more. This book also contains a significant number of practical issues. The views of Ind AS Transition Facilitation Group (ITFG) of ICAI and Educational Materials issued by ICAI have also been duly considered while analyzing the concepts and are accordingly presented in the book. Author believes this book will simplify the standards for the readers and also help them in implementing Ind AS.

This book helps understand: what are Ind AS; how to transition to Ind AS from Indian GAAP; how Ind AS affects the key components of financial statements; how accounting information is to be disclosed in the financial statements; and much more. The book presents the fundamental accounting concepts of Ind AS, explains the concepts like Other Comprehensive Income, deferred taxes, financial instruments, business combinations, etc. in lucid language, and also presents the Ind AS, e.g. Ind AS 115 Revenue from contracts with customers, Ind AS 116 Leases and others.

The book also contains more than 500 MCQS and questions for practice for the students of Chartered Accountancy and Professionals appearing for certification courses on Ind AS.

Also book contains a chapter on COVID-19, where impact on financial reporting are discussed in Q&A format.

KEY FEATURES OF THE BOOK

- Lucid commentary with Conceptual Explanations & Examples

- Includes Commentary on Ind AS 116 with examples

- Includes all amendments till 31st July 2022 including latest amendments to Schedule III

- Multiple Choice Questions (MCQs) and Practice Questions for students

- Standard-wise carve-outs between IFRS and Ind AS

- FAQs on MCA Notifications for Roadmap/ Applicability of Ind AS

- Practical issues on Ind AS including analysis of ITFG Bulletins and Educational Material

- Impact of Ind AS on different sectors

- Minimum Alternate Tax impact on Ind AS adjustments

- Including Illustrative Financial Statements based on Ind AS

- Amended by IND As amendment Rules dated 31-07-2022.

Details :

- Publisher : Commercial Law Publishers (India) Pvt. Ltd.

- Author : Anand J. Banka

- Edition : 5th Edition August 2022

- ISBN-13 : 9789356030428

- ISBN-10 : 9789356030428

- Binding: Paperback

- Language : English

| Publisher | |

|---|---|

| Author | |

| Language |

Be the first to review “Commercial’s Ind AS Simplified – A Comprehensive Commentary Explained with Illustrations By Anand J. Banka – 5th Edition 2022” Cancel reply

Related products

MSME

Bloomsbury’s Treatise on Micro, Small and Medium Enterprises by Rajeev Babel – 1st Edition June 2021

Reviews

There are no reviews yet.