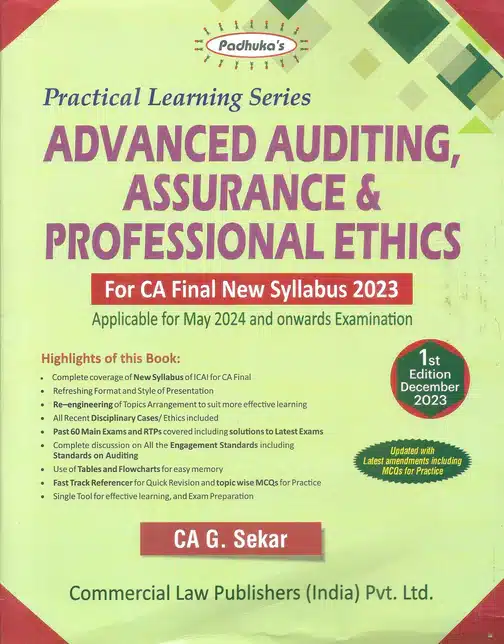

Commercial’s Practical Learning Series – Advanced Auditing, Assurance & Professional Ethics by G Sekar for May 2024 Exam

₹1,299.00 Original price was: ₹1,299.00.₹1,104.00Current price is: ₹1,104.00.

Commercial’s Practical Learning Series – Advanced Auditing, Assurance & Professional Ethics (CA Final) (New Syllabus) by G. Sekar for May 2024 Exam – 1st Edition December 2023.

10 in stock

Commercial’s Practical Learning Series – Advanced Auditing, Assurance & Professional Ethics (CA Final) (New Syllabus) by G. Sekar for May 2024 Exam – 1st Edition December 2023.

Commercial’s Practical Learning Series – Advanced Auditing, Assurance & Professional Ethics (CA Final) (New Syllabus) by G. Sekar for May 2024 Exam – 1st Edition December 2023.

CONTENTS:

Commercial’s Practical Learning Series – Advanced Auditing, Assurance & Professional Ethics (CA Final) (New Syllabus) by G. Sekar for May 2024 Exam – 1st Edition December 2023.

Comprehensive Coverage of all the topics in the CA Final Syllabus

Refreshing format and style of Presentation

Re-Engineering of Topics arrangement to suit more effective Learning

All Recent Disciplinary Cases/Ethics Included

Past 60 Main Exams and RTPs covered Including Solution to Latest Exams

Complete Discussion on all the engagement Standards Including Standards on Auditing

Use of Tables and Flowcharts for easy memory

Single tool for Effective Learning and Exam Preparation

About Author:

G. Sekar is a Chartered Accountant in practice for the last 33 years.

Founder and Faculty of Direct Taxation in Shree Guru Kripa’s Institute of Management, an Institution providing education for all levels and all subjects of the Chartered Accountancy Courses and has trained many finance professionals.

Member – Central Council of ICAI – 2013-16, 2016-19 & 2019-22.

Chairman – Direct Taxes Committee of ICAI – 2014.

Chairman – Auditing And Assurance Standards Board of ICAI – 2019 & 2020.

Great Motivator for Chartered Accountants in Practice and in Employment, and CA Students, through his effective and convincing communication style.

1. Commerce Graduate, Gold Medalist & Rank Holder from Madurai Kamaraj University.

2. Member of Expert Study Group Committee, CBDT, New Delhi, to study the Direct Tax Code Bill in 2006.

3. Recipient of Special Award from the Income Tax Department in 2011, during their “150 years of Income Tax in India” Celebrations, for his contribution and service to the Income Tax Department.

4. Speaker on Budget, Direct and Indirect Taxation in Doordarshan & other Television Channels & Print Media Programmes.

5. Board Member, Airports Authority of India (2019-22).

6. Member of Consultative Advisory Group (CAG) of IFAC-2017-19, International Accounting Education Standards Board (IAESB). It is worthy to note that he is the First Indian to be part of the CAG.

7. Faculty Member of The Institute of Chartered Accountants of India and its Branches, and other Professional and Management Institutions, for CA Intermediate/IPCC and CA Final Level, for the subjects Income Tax, Service Tax, VAT, Direct Tax Law, etc.

8. Author of Professional Books – for Finance and Legal Professionals, Corporate Taxpayers, Banks, Officials of Income Tax Department, etc.

(a) Handbook on Direct Taxes – (Recommended for IRS Trainees at NADT)

(b) Professional Manual on Accounting Standards

(c) Practical Guide on TDS and TCS – (Approved Book for ITOs)

(d) Professional Guide to Tax Audit

(e) Personal Income Tax – A Simplified Approach

(f) Professional Guide to CARO 2016

(g) A Professional Guide to Income Computation & Disclosure Standards (ICDS)

(h) Handbook for The Insolvency and Bankruptcy Code, 2016

(i) Author of Special Series GST Books for Professionals – GST Manual, GST Self Learning, GST Ready Reckoner.

9. Author of Books for CA Students – Authored about 27 Books covering the entire curriculum of CA Course. Shree Guru Kripa’s Institute of Management is the First and Only Educational Institution in India to accomplish this feat.

Details:

- Publisher: Commercial Law Publishers (India) Pvt. Ltd.

- Author: G Sekar & B Saravana Prasath

- Edition: 1st Edition December 2023

- ISBN-13: 9789356035140

- ISBN-10: 9789356035140

- Binding: Paperback

- Language: English

| Publisher | |

|---|---|

| Author | |

| Language |

Be the first to review “Commercial’s Practical Learning Series – Advanced Auditing, Assurance & Professional Ethics by G Sekar for May 2024 Exam” Cancel reply

Related products

Auditing and Assurance

Taxmann’s Auditing & Assurance by Pankaj Garg for Nov 2023 Exams

Jurisprudence, Interpretation & General Laws

Taxmann’s Cracker – Jurisprudence Interpretation & General Laws by N.S Zad for June 2024

Financial Reporting

Snow White’s First Lessons in Financial Reporting by M.P. Vijay Kumar for Nov 2023

Advanced Auditing and Professional Ethics

Advanced Auditing and Professional Ethics

Reviews

There are no reviews yet.