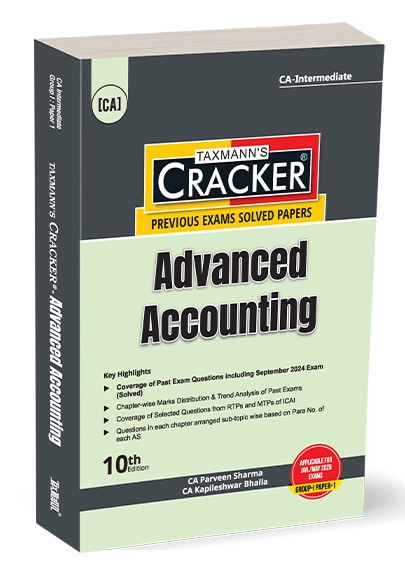

Taxmann’s Cracker – Advanced Accounting by Parveen Sharma for Jan 2025

₹945.00 Original price was: ₹945.00.₹803.00Current price is: ₹803.00.

Taxmann’s Cracker – Advanced Accounting (CA-Intermediate) (New Syllabus) by Parveen Sharma for Jan 2025 Exams – 10th Edition October 2024. The standout features of this book include a comprehensive collection of past exam questions with detailed solutions (including the September 2024 exam), organised sub-topic-wise as per Ind AS para numbers. It also offers chapter-wise marks distribution, exam trend analysis from May 2024, and a thorough comparison with ICAI study material. Additionally, it incorporates questions from ICAI’s RTPs and MTPs, ensuring complete exam readiness. CA Inter | New Syllabus | Jan./May 2025 Exams.

10 in stock

Taxmann’s Cracker – Advanced Accounting (CA-Intermediate) (New Syllabus) by Parveen Sharma for Jan 2025 Exams – 10th Edition October 2024.

Taxmann’s Cracker – Advanced Accounting (CA-Intermediate) (New Syllabus) by Parveen Sharma for Jan 2025 Exams – 10th Edition October 2024.

Description

This book is prepared exclusively for the Intermediate Level of Chartered Accountancy Examination requirement. It covers the past exam questions & detailed answers strictly as per the new syllabus of ICAI.

The Present Publication is the 10th Edition for the CA Inter | New Syllabus | Jan./May 2025 Exams. This book is authored by CA Parveen Sharma & CA Kapileshwar Bhalla, with the following noteworthy features:

- Strictly as per the New Syllabus of ICAI

- Coverage of this book includes:

- Past Exam Questions with Answers, including the September 2024 Exam (Solved)

- Questions from RTPs and MTPs of ICAI

- [Arrangement of Question] Questions in each chapter are arranged ‘sub-topic’ wise based on Para No. of each Ind AS

- [Marks Distribution] is provided Chapter-wise from May 2024

- [Exam Trend Analysis] for the previous exams from May 2024

- [ICAI Study Material Comparison] is provided chapter-wise

Contents of the book are as follows:

- Introduction to Accounting Standards

- Framework for Preparation & Presentation of Financial Statements

- Applicability of Accounting Standards

- Presentation & Disclosures Based Accounting Standards

- Asset-Based Accounting Standards

- Liabilities-Based Accounting Standards

- Accounting Standards Based on Item-Impacting Financial Statements

- Revenue-Based Accounting Standards

- Other Accounting Standards

- Consolidated Financial Statements

- Financial Statement of Companies

- Buy-Back & Equity Shares with Differential Rights

- Amalgamation

- Internal Reconstruction

- Branch Accounting

Details :

- Publisher : Taxmann

- Author : CA Parveen Sharma

- Edition : 10th Edition October 2024

- ISBN-13 : 9789357788076

- ISBN-10 : 9789357788076

- Language : English

- Binding : Paperback

| Publisher | |

|---|---|

| Author | |

| Language |

Be the first to review “Taxmann’s Cracker – Advanced Accounting by Parveen Sharma for Jan 2025” Cancel reply

Related products

Indirect Tax Laws

Taxmann’s Quick Revision Charts for Indirect Tax Laws (CA-Final) by V.S.Datey for Nov 2020 Exams

Auditing and Assurance

Taxmann’s Cracker – Auditing & Ethics (Auditing) by Pankaj Garg for Jan 2025 Exams

Direct Tax Laws & International Taxation

Taxmann’s Direct Taxes Law & Practice by Vinod K Singhania for Nov 2024 Exams

Setting up of Business Entities and Closure

Taxmann’s Setting up of Business Entities & Closure by N.S Zad for June 2023

Financial and Strategic Management

Taxmann’s Cracker – Financial & Strategic Management by N S Zad for June 2024

Corporate and Economic Laws

Taxmann’s Cracker – Corporate & Economic Laws by Pankaj Garg for Nov 2023 Exams

Commercial's Systematic Approach to Income Tax by Dr. Girish Ahuja for May 2024 Exam

Commercial's Systematic Approach to Income Tax by Dr. Girish Ahuja for May 2024 Exam

Reviews

There are no reviews yet.