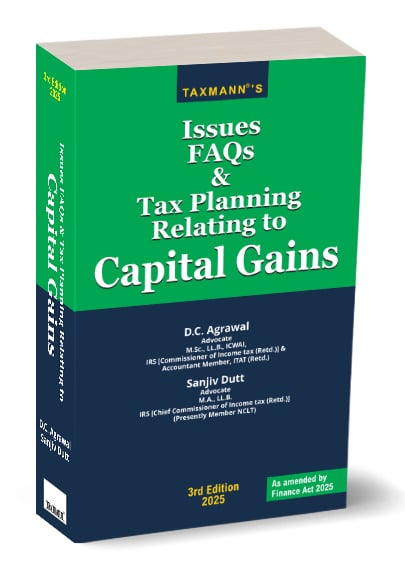

- Binding : Paperback

- Publisher : Taxmann

- Author : D.C. Agrawal, Sanjiv Dutt

- Edition : 3rd Edition 2025

- Language : English

- ISBN-10 : 9789364550062

- ISBN-13 : 9789364550062

Taxmann’s Issues FAQs & Tax Planning Relating to Capital Gains by D.C. Agrawal

₹3,495.00 Original price was: ₹3,495.00.₹2,621.00Current price is: ₹2,621.00.

Taxmann’s Issues FAQs & Tax Planning Relating to Capital Gains – As Amended by Finance Act, 2025 by D.C. Agrawal – 3rd Edition 2025. Issues FAQs & Tax Planning Relating to Capital Gains (3rd Edition | 2025) is a comprehensive treatise on India’s capital gains tax, meticulously updated by the Finance Act 2025. Organised across 55 chapters, it addresses over 1,200 FAQs on 680+ topics, ranging from real estate and shares to business restructuring. Authored by D.C. Agrawal and Sanjiv Dutt, this book cites 3,200+ landmark judgments, offering step-by-step explanations, practical tips, and detailed analyses. Its accessible Q&A format simplifies complex provisions, making it an essential resource for professionals, businesses, students, and individual taxpayers.

10 in stock

Taxmann’s Issues FAQs & Tax Planning Relating to Capital Gains – As Amended by Finance Act, 2025 by D.C. Agrawal – 3rd Edition 2025.

Taxmann’s Issues FAQs & Tax Planning Relating to Capital Gains – As Amended by Finance Act, 2025 by D.C. Agrawal – 3rd Edition 2025.

Description

Issues FAQs & Tax Planning Relating to Capital Gains (3rd Edition | 2025) is a comprehensive and practice-oriented guide dedicated to simplifying the legal and practical nuances of capital gains taxation in India. Meticulously updated by the Finance Act 2025, this volume seeks to serve as a one-stop reference for readers who grapple with capital gains issues—whether in real estate, shares & securities, business restructuring, or any other applicable areas. The book highlights typical queries faced by taxpayers, professionals, and the legal community, presenting well-researched solutions supported by landmark judicial decisions. With approximately 1,200 questions covering 680+ topics, the work simplifies capital gains taxation while preserving depth and accuracy.

This book is intended for the following audience:

- Tax Professionals & Lawyers – Chartered Accountants, Advocates, and Tax Consultants will benefit from the book’s extensive coverage of practical scenarios and judicial precedents

- Corporate Tax Departments & Businesses – CFOs, finance managers, and tax teams dealing with asset transfers, mergers, acquisitions, or real estate transactions will find clarity in its structured question-answer format

- Students of Law & Commerce – The content is simplified into FAQs, making it easier for law, commerce, or tax students to learn and understand key principles

- Individual Taxpayers & Investors – Anyone looking to plan and save on capital gains tax—whether selling properties or trading in shares/mutual funds—will gain insights into allowable exemptions and correct procedures

The Present Publication is the 3rd Edition | 2025, amended by the Finance Act 2025. This book is authored by D.C. Agrawal and Sanjiv Dutt, with the following noteworthy features:

- [Finance Act 2025 Amendments] Reflects all crucial reforms introduced by the latest amendments, ensuring users have up-to-date guidance

- [Question-Answer Format] Organises material as around 1,200 FAQs, making complex legal provisions easy to grasp

- [Judicial Precedents] Cites over 3,200 landmark judgments from the Supreme Court, High Courts, and Income Tax Appellate Tribunal, with context and analyses

- [Extensive Topical Coverage] Covers everything from the cost of acquisition, indexation, and exemptions (Sections 54, 54F, 54EC, etc.) to special provisions for joint development agreements, slump sale, compulsory acquisition, etc.

- [Practical Insights] Step-by-step explanations of typical queries, pitfalls, do’s and don’ts, plus references to official clarifications and notifications

- [Practical Relevance] The book places special emphasis on capital gains issues unique to India’s tax system, such as circle rates (stamp duty valuations), farmland transactions, complex shareholding structures, and frequent legislative changes. It aims to enable professionals and taxpayers alike to navigate these intricacies with clarity

- [Expert Authors] Written by two accomplished advocates and former IRS officers with decades of hands-on experience in investigations, appellate work, and tax administration

The coverage of the book is as follows:

- Foundational Concepts

- Definition and scope of capital asset, agricultural land classification, and the rationale behind capital gains taxation

- Types of Capital Gains

- In-depth discussion on Short-Term vs. Long-Term Capital Gains, determining holding periods, and business income vs. capital gains classification

- Computation Mechanics

- Stepwise breakdown of Section 48, including cost of acquisition, cost of improvement, indexation nuances, and full value of consideration under Sections 50C, 50CA, 50D, etc.

- Special Provisions

- Capital Gains on Depreciable Assets (Section 50)

- Slump Sale (Section 50B)

- Market Linked Debentures (Section 50AA)

- Joint Development Agreements (Section 45(5A))

- Transfers at the Time of Dissolution/Reconstitution of Firms (Sections 45(3), 45(4), and 9B)

- Buy-back of Shares (Section 46A)

- International Financial Services Centre (IFSC) and International Taxation aspects

- Exemptions & Tax Planning

- A thorough explanation of sections 54, 54EC, 54F, 54B, 54D, 54G, 54GA, and 54GB, including recent changes about investment in startup funds, bonds, and other permissible avenues

- Capital Gains Accounts Scheme

- How to use CGAS to avail exemption when the timely purchase or construction of new assets is pending

- Procedural & Litigation Aspects

- Discussion on references to valuation officers (Section 55A), set-off of capital losses (Sections 70, 74), and interplay with other heads of income

- Miscellaneous Queries

- Covers wide-ranging issues from family settlements, partial sale, gifts, disclaimers, etc.

The structure of the book is as follows:

- Chapter-wise Organisation – 55 chapters progress systematically from conceptual basics to complex transaction analysis

- Sub-topic Headings – Each chapter is further sub-divided for quick cross-referencing—helpful for both novices and seasoned practitioners

- Extensive FAQ-Style Format – Nearly every potential problem scenario or confusion is addressed with a direct question, followed by a succinct, solution-oriented answer

- Relevant Judicial Decisions & Examples – Each question is supported by case law references and, where relevant, numeric illustrations or flowcharts to clarify computations

- Planning & Practice Tips – Concludes chapters with checklists or short tips to avoid pitfalls, enabling you to pinpoint compliance requirements and potential tax savings quickly.

Details

| Language | |

|---|---|

| Author | |

| Publisher |

Whitesmann's Commentary on The Narcotic Drugs and Psychotropic Substances Act, 1985 by Yogesh V Nayyar - Edition 2023

Whitesmann's Commentary on The Narcotic Drugs and Psychotropic Substances Act, 1985 by Yogesh V Nayyar - Edition 2023

Reviews

There are no reviews yet.